by Joshua Chappell, Embed

The effects of the universal 10% tariff on all imports into the US are felt across various industries worldwide. The family entertainment and amusement industries are not exempt from the rising costs of doing business that entail product procurement and supplier selection outside the Americas.

For a lot of operators, navigating the possible current and future effects of the tariff enactment means rethinking the overall costs of ordering new hardware and supplies abroad, not to mention the longer time it will take to offset or breakeven for games, given the added costs.

This also means possibly looking into supplier alternatives in Canada or overseas, or simply those who are still offering their pre-tariff pricing just to move months’ worth of inventory.

Cashless and cloud-based business solutions can move family entertainment businesses towards digital transformation to boost operational efficiency, lower maintenance costs, reduce manpower, and create new revenue streams.

Going cashless or accepting cashless payments like mobile wallets can help offset rising costs through higher average guest spend. Kiosks with smart booking integrations can help operators sell game cards and enjoy arcade games or attractions while giving guests the ability to try out their other offerings.

The benefits of mobile wallet tech

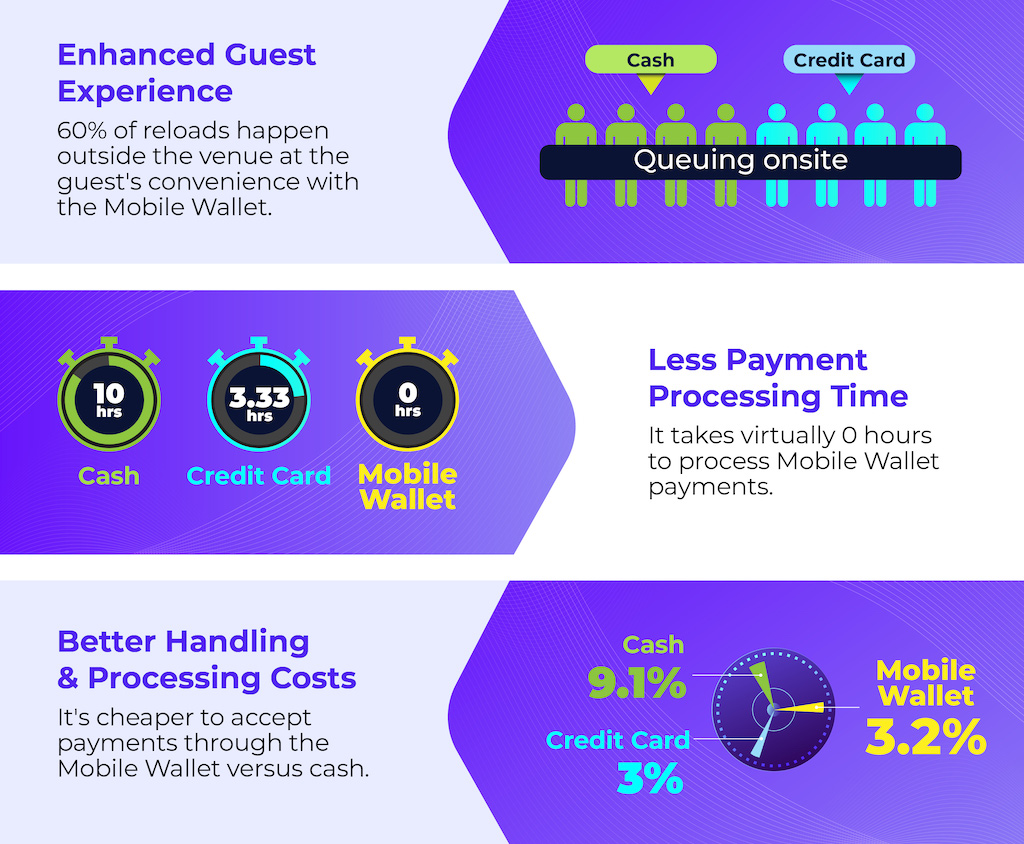

We can’t underestimate how much digitisation can help increase savings or lower and offset costs. For instance, adopting a mobile wallet technology can give the following benefits:

Reduced cash handling costs, fraud, and theft

Based on a $50 average transaction, handling cash costs 9.1% versus 3% for credit card payments and 3.2% for mobile wallet payments.

Mobile wallet transactions are also linked to less token fraud (using other coins or tokens from certain FECs) and theft. With payments going straight to the business account from guests’ Apple Wallet or Google Wallet, customers won’t fear losing game cards and going crazy over reload value.

Better upselling opportunities

Operators can offer bonus credits and value bundles exclusively for mobile payments. This creates new revenue streams and drives higher profitability. It’s also proven that consumers tend to spend more when paying with the preferred cashless modes of payment.

Legacy FEC Fun Factory experienced more-than-double revenue growth thanks to the mobile wallet (with supplementary mobile wallet staff training to increase guest usage), with significant growth in higher-value reloads ($100 reloads at 147%). You can also check out more mobile wallet training success stories here.

Improved customer targeting and marketing ROI

Mobile wallets and other digital solutions have data capture capabilities that store guest information to help operators create effective marketing campaigns, high-value, low-cost promotions, and experiences patrons will love.

Promoting guest convenience with mobile-first solutions in the FEC could lead to a 5x increase in average reload value—that’s a jump from $9.90 cash reload value to $50.57 Mobile Wallet reload on average.

Higher operational efficiency

Because of guest convenience, mobile wallets or other digital solutions cut long lines from counters and prevent guests from walking out the door to avoid queuing.

This also means staff have more time on their hands to focus on the overall guest experience and offer upsell opportunities thanks to reduced guest friction.

Staying ahead of the curve

Embracing cashless technology can mean a world of difference to businesses trying to rise above tariff issues.

With the advancement of cashless and cloud-based solutions, as well as the incredible capabilities of AI, FECs can stay ahead of the curve and mitigate some of the effects of the tax transition.