Habo, a consulting firm that provides strategic planning and market/consumer intelligence, evaluated the US immersive experiences market in 2024, using proprietary data from its work in this fast-growing sector. Although global growth is substantial, the United States has emerged as a significant centre for these innovative entertainment formats.

The firm estimates that revenues from immersive experiences in the US hit $3.9 billion in 2024, indicating an average annual growth rate of 21% since 2019, when the market was worth $1.5 billion.

This outcome highlights the strategic opportunities within the immersive experience industry for producers, investors, technology providers, and other key market participants. This market assessment includes revenues from immersive experiences in the US in 2024, covering the eight categories defined by Habo.

What is behind this rapid growth?

- Rising awareness and audience interest: An increasing number of people are attracted to immersive experiences, engaged by their novelty and the opportunity to interact with intriguing ideas.

- Expanding offerings: A growing number of players are joining the market with various formats, expanding access to these experiences for a wider audience, including areas beyond major urban centres.

- Significant investments: Additional investments in infrastructure, content, advanced technology, and marketing strategies are fuelling market growth and increasing visibility among consumers.

These dynamics are creating a more structured ecosystem for the industry.

Challenges that could impact future growth

- Market saturation and consumer perception: The swift increase in available options has resulted in lower-quality or repetitive experiences, which might cause consumer fatigue and alter perceptions of immersive experiences overall.

- Economic models and risk-adjusted returns: Many types of experience are still looking to establish scalable economic models that yield risk-adjusted returns. To attract investors, they need to discover creative methods to reconcile the quality of experience with the size of the development budget, the maximum throughput with operating expenses, and the visitor value with acquisition costs.

- Economic context: An economic downturn may affect consumers’ purchasing ability and investors' willingness to take risks, necessitating that the sector preserves its attractiveness in the face of increasing competition within the entertainment industry.

Immersive experience categories are growing at different speeds

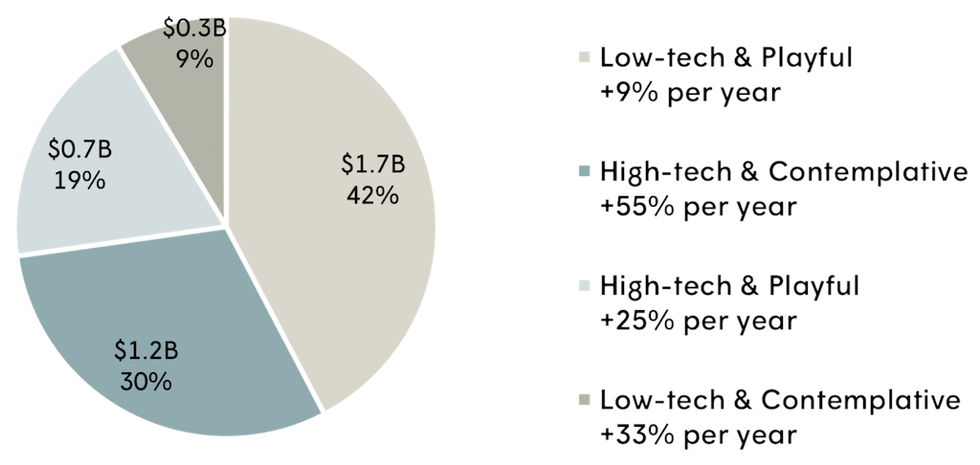

Habo segmented its market assessment into four primary categories of immersive experiences. These are high-tech & contemplative, high-tech & playful, low-tech & contemplative, and low-tech and playful.

Legend:

- High-tech & contemplative

- High-tech & playful

- Low-tech & contemplative

- Low-tech & playful

The company’s evaluation reveals that growth is not evenly distributed across these segments, as shown in this graphic of market size and average annual growth by immersive experience segment, taking average growth rates over the 2019-2024 period.

High-tech and contemplative (+55% per year): This segment is experiencing rapid growth, fueled by increased immersive exhibitions and outdoor walkthroughs. These attractions usually cater to a broad audience, including families and adults, and use operational strategies to maximise profits through significant foot traffic.

Establishing permanent venues with the necessary technology bodes well for the segment’s future. Nevertheless, its success heavily relies on the attractiveness of the theme or the intellectual property associated with the content, and consumer weariness may pose a challenge. Innovative offerings incorporating advanced immersive technologies strive to enhance their economic frameworks.

Low-tech and contemplative (+33% per year): Although it accounts for under 10% of the market, this segment attracts consumers seeking shareable social media content. Its minimal barriers to entry have facilitated growth across various market sizes. Although offerings are still fragmented, the success of popular franchises indicates a trend towards greater stability.

High-tech and playful (+25% per year): Following challenges during the pandemic, immersive arcade games have seen a resurgence in the US since 2022. Enhancements in standalone VR headsets have significantly improved interactivity and immersion, leading to more engaging experiences and increased repeat visits.

The growth of this segment across US markets is supported by franchise and licensing models that allow for localised operations. At the same time, immersive excursions are also becoming more popular, though high development costs and complex operations still constrain their expansion.

Low-tech and playful (+9% per year): This segment represents the most significant portion of industry revenue, yet it has experienced the slowest growth since 2019. While immersive role-play and escape games have been well-established for years and possess a broad audience, their fragmentation hinders further expansion.

On the other hand, immersive family entertainment centres (FECs) continue to attract their target demographics, utilising popular intellectual properties to boost merchandise sales.

Factors that influence success

Habo says that producers aiming to establish a foothold in the immersive experiences sector need to confirm several essential elements to guarantee the success of their concept:

- Validate audience interest: Create a concept design that connects with target audiences by developing a strong value proposition that is effectively communicated.

- Analyse the market environment: Evaluate demand and competition to identify the best strategic position, considering commercial goals, target audience, and experience features.

- Choose a strategic location: Identify ideal locations by evaluating the size of the addressable market, socioeconomic factors, and competitive intensity both across markets and within specific regions.

- Build realistic and reliable business projections: Establish strong business assumptions that back the forecast, grounded in the concept’s proven market potential. This approach promotes a sustainable economic model while mitigating risks.

Charlotte Coates is blooloop's editor. She is from Brighton, UK and previously worked as a librarian. She has a strong interest in arts, culture and information and graduated from the University of Sussex with a degree in English Literature. Charlotte can usually be found either with her head in a book or planning her next travel adventure.

Images provided courtesy of High Note Events and Experiential Media Group

Images provided courtesy of High Note Events and Experiential Media Group Images provided courtesy of High Note Events and Experiential Media Group

Images provided courtesy of High Note Events and Experiential Media Group