by Bart Dohmen, TDAC International

For many years, traditional theme parks were viewed as primarily serving the mass market, popular with families, but rarely seen as aspirational destinations by higher-income guests.

Today, that perception has shifted significantly. Europe’s most iconic theme parks have evolved into premium leisure resorts, increasingly catering to more affluent segments.

This evolution is reshaping the market and creating fresh opportunities for new models and audiences.

To illustrate the shift: a day at Disneyland Paris for a family of five, including Premier Access and food & beverage, can now cost close to the EU’s average monthly net salary. While Disneyland represents the upper end, similar trends are evident across leading European parks.

And that’s not even including the cost of staying overnight, something that’s increasingly essential, as major parks now offer so much that one day simply isn’t enough. Therefore, most of these parks promote multi-day stays in themed on-site hotels, where rates can exceed €100 per person per night, often not including park entry.

The result is a growing perception of these destinations as aspirational or luxury getaways, less accessible to traditional family audiences, particularly those with young children.

Why are prices rising?

In my opinion, there are two primary drivers behind this shift. Number one is the fact that market leadership in the theme park world demands constant innovation. Top-tier parks must maintain a competitive edge.

That means delivering increasingly immersive environments, high-capacity rides with original IPs, and hospitality standards that rival top-tier resorts. Restaurants are expected to be themed and offer elevated cuisine. Staff training and operational standards must reflect an upscale hotel service level.

These quality improvements come with significantly higher operational and capital expenditure, which is inevitably reflected in the guest ticket price.

The second driver is the rise of the short break economy. A few decades ago, the short-break market was relatively limited. Today, millions of Europeans regularly invest in short leisure breaks, city trips, spa weekends, and nature retreats.

Theme park resorts have capitalized on this trend, repositioning themselves as all-in-one destinations, suitable for a more than one-day stay. That shift has broadened the appeal to couples and adults without children, but also moved the product towards the upmarket.

As a result, the guest profile at many destination parks is evolving. Families, especially those with younger children, are increasingly priced out. At the same time, parks are seeing growth in adult couples, seniors, and DINK (dual-income, no kids) travelers, guests who value themed experiences and premium hospitality over thrill rides.

Theme parks embrace this by offering wellness treatments, luxury dining, and evening shows more catered to adults.

Segmentation

At the same time, younger children don’t need high-thrill coasters, multimillion-euro dark rides, or elaborate storytelling to have a great time. They’re often just as thrilled by simple attractions and imaginative playgrounds. As a result, many families are turning to alternative experiences that are more affordable, lower-intensity and closer to home.

This shift isn’t a sign of decline; it’s a sign of maturity. Like the hospitality sector, which ranges from budget hostels to luxury resorts, the attractions industry is now segmenting. We’re seeing clear product differentiation emerge, tailored to diverse guest needs and varying budgets.

In fact, this evolution is creating space for new concepts and unlocking opportunities in underserved market segments.

At TDAC, as theme park consultants, we see a growing number of successful models that cater to families with smaller children, without the premium price tag. Here are some examples:

- Momentum Group ’s indoor/outdoor parks offer compact rides and themed environments at a very affordable price level.

- Karls Erlebnis-Dorf has adopted an innovative hybrid model: no entry fee, free play zones, and retail-focused entertainment. Guests pay per ride or opt for an affordable all-inclusive day pass. Their approach caters for both young guests and grown-ups.

- Irrland in Germany focuses on hands-on experiences, water play, and no mechanical attractions, all at extremely low admission fees, attracting over a million guests annually.

- Schloss Dankern combines bungalow accommodation with an expansive indoor/outdoor playground. If you’re staying there, all attractions are included, guaranteeing great family time for an affordable price.

These parks may not compete on IP or coaster height, but they deliver something just as valuable: affordability, accessibility, and meaningful family time. They represent a new wave of leisure destinations built on simplicity, flexibility, and local relevance.

Premium theme parks: maturity leads to opportunities

The rise of premium and luxury theme parks and resorts is a sign of industry growth, but so is the increase in budget-conscious alternatives.

As an industry, we’re seeing diversification in offerings, price points, and target audiences. Like the hotel sector, where 2- to 5-star experiences coexist to serve different segments, the theme park industry is now capable of serving a full spectrum of guests, from luxury-seeking couples to young families on a budget.

And in that diversity lies resilience, innovation and long-term sustainability.

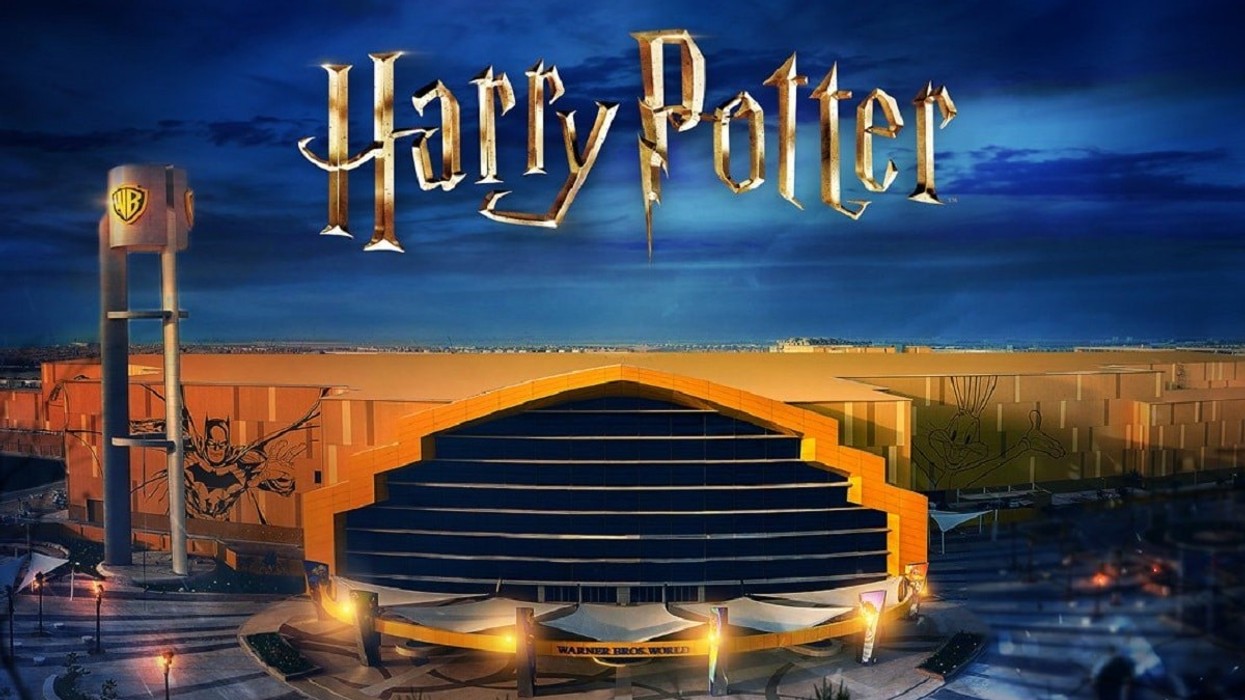

Death Eaters at Universal Orlando's Diagon Alley

Death Eaters at Universal Orlando's Diagon Alley  Hogwarts Castle

Hogwarts Castle