by James Kennard, partner, and Isabel Gross, associate, Leisure Development Partners

India is huge, not just in land area but in population. Estimates vary, but according to most sources, the population of India surpassed China’s (the next biggest) in 2022, and there are now an estimated 1.43 billion residents.

Big populations normally mean big opportunities for leisure and entertainment, but the profile of the population matters. Historically, India's population has been young but with relatively poor spending power. As we explore in this article, the population is still young and growing, but wealth and spending power are improving dramatically.

At LDP, we have completed many market and feasibility studies in the subcontinent. Until recently, the broader market hasn’t seemed quite ready for top-tier attractions and location-based entertainment (bar a couple of notable successes). Quality attractions are typically capital-intensive and, as a result, usually need big markets with the right profile and good spending power to drive reasonable returns on investments (ROIs).

With incomes rising and a burgeoning middle class across India, is she ready for a wave of new and innovative entertainment? We think so.

Indeed, on a recent trip to India (Mumbai), the change from our last visit to the city between 5 and 10 years ago was palpable. We understand that each submarket is unique, but in Mumbai, in particular, the speed of development in terms of infrastructure and connectivity and the emergence of premium products and brands was evident.

The latter trend is particularly encouraging when considering some of the newer entertainment concepts at Jio World Drive and Jio World Plaza in Mumbai.

Changing demographics in India lead to more demand for attractions

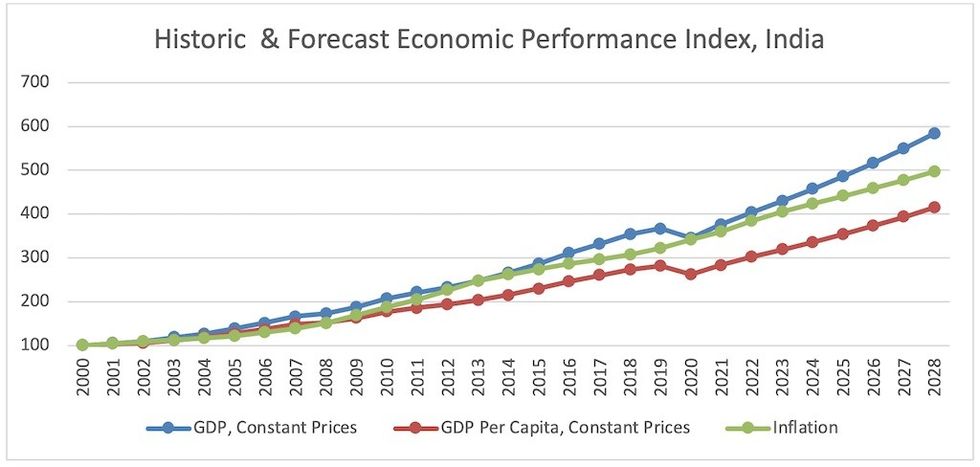

One of the major trends across India in recent years has been the socio-economic shift in the population. From our first chart, we can see that growth in GDP per capita across India has been rising inexorably (bar something of a slip during the pandemic ), and this is having a marked impact on the population's profile.

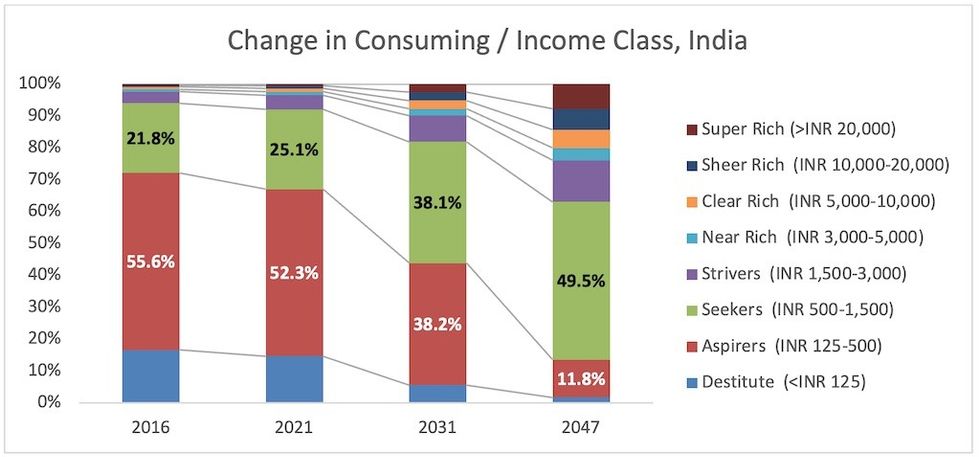

Data sourced from People Research on India’s Consumer Economy (or PRICE) suggests that India has been witnessing strong population growth and that people are rapidly shifting into higher income categories.

This trend is strikingly demonstrated in the chart below, which shows a shift in the proportion of the population into the higher income groups over the past five years and is expected to keep on this trajectory. With more people within aspirational socio-economic groups, a more significant proportion of the population has disposable income to spend on leisure and entertainment.

Tourism opportunity

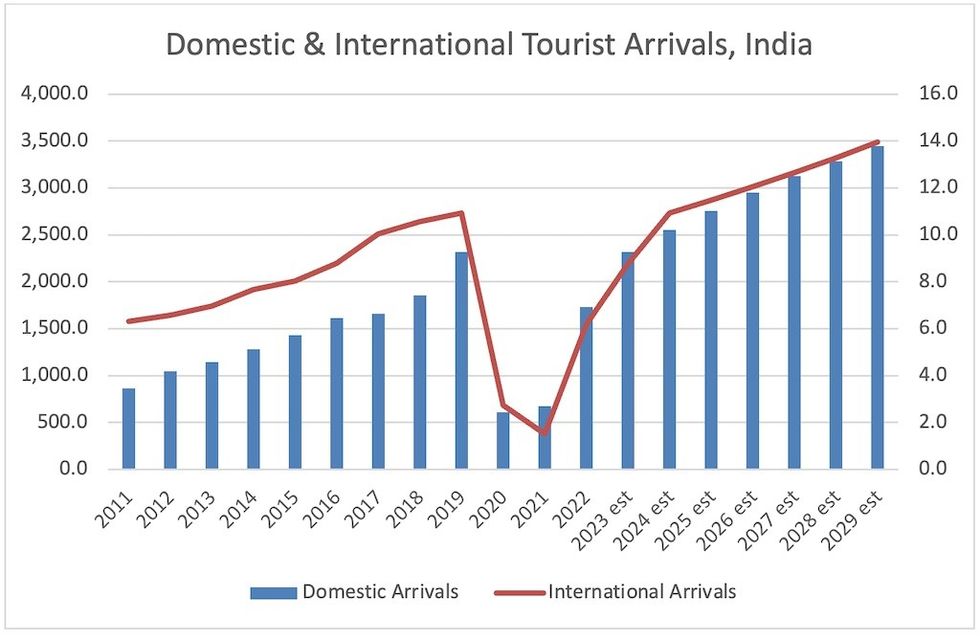

Residents are typically a fundamental source of demand for attractions, but depending on the offer and market context, tourists can also be a crucial source of visitation. India is a well-established international tourist destination with some world-beating cultural attractions, but what is notable from the chart below is how much the domestic tourist market dwarfs the international tourist market.

This is not surprising given the country's size, and as wealth improves, the propensity to travel will only drive increases in domestic tourism. For potential attraction investors or developers, understanding the profile of the residents (size, income, age, etc.) and domestic and international tourists (size, reason for visit, length of stay, seasonal patterns, etc.) will be critical in estimating future potential demand.

India's nascent attractions sector

The attractions sector in India is at a relatively early stage of development. Some well-established theme and water parks are in the market, including Wonderla Parks (Bengaluru, Kochi, and Hyderabad), Nicco Park (Kolkata), Essel World (Mumbai), and Ramoji Film City (Hyderabad).

There is also a clutch of higher-quality branded attractions (for example, KidZania currently operates in New Delhi and Mumbai) that operate in the country. Still, otherwise, the depth and quality of the attractions market is modest. In major cities, malls tend to have an improving and diverse cinema offering now with premium seating/experiences, but a range of smaller indoor play and family entertainment centres generally characterise the attractions supply.

Developing new attractions and entertainment requires strong spending power, and the markets appear to be reacting to improved disposable incomes.

Looking at a basket of attractions across some major cities, we can see that prices at some leading attractions have grown by approximately seven percent per annum over seven years and that cinema prices jumped 30-35 percent over a similar period. There has been strong underlying inflation, but attractions and leisure ticket price growth has more than outpaced this.

Opportunities

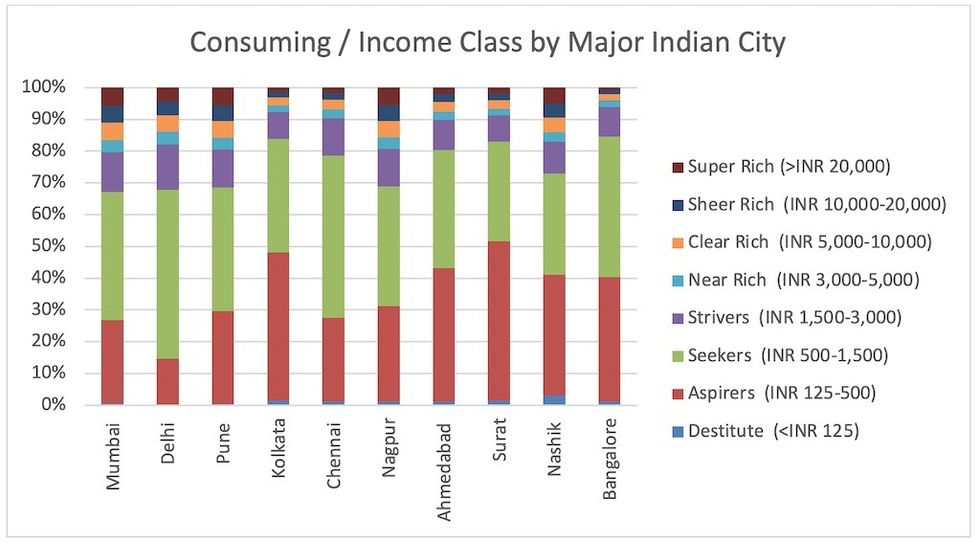

Our final chart demonstrates the population profile across some of the major cities in India. The data suggests some major cities have a more favourable demographic profile than others (the population of New Delhi looks relatively wealthy as compared to, say, Kolkata). However, these differences are likely to be softened as the rapid growth of wealth at a national level underwrites positive change across all the cities.

The data also does not consider other factors. The scale of the markets and the current or planned competitive landscape in each market are also key considerations. For potential investors or developers in India, we believe the time to start planning for new attractions and entertainment is now.

It can take years to develop new attractions. With such fast-paced socio-economic change and growing tourist numbers, there will likely be good opportunities, particularly for first movers. However, a thorough understanding of the available markets and the local and regional attractions market should be prioritised when planning this type of development.

While homegrown concepts and some limited franchises have been the order of the day so far, the growing incomes, enormous populations, and significant domestic tourism must surely place India on the strategic growth list for visitor attractions licensors, operators, investors, suppliers, and professional services firms.

LDP has seen an uptick in demand for our services in this market, and we very much look forward to raising the bar in India with the rest of the industry and local and regional investors.

Vama Communications

Vama Communications Vama Communications

Vama Communications Vama Communications

Vama Communications