See also: The 26 best new roller coasters for 2026

26) Cave Fantasy w/ the Fantasy Flight Theater - Thailand

A new all-indoor attraction that just opened in early 2026 inside Bangkok’s MBK Center.

This features a number of unique mini-attractions and experiences, many of which involve standing in CAVE-style projection rooms where viewers are surrounded on five sides by high-resolution screens, including one you can see through the clear floor below your feet.

The experience also includes the Fantasy Flight Theater, which is essentially a flying theater-style experience that also uses a CAVE-style projection room instead of surrounding the viewer with a domed scene.

25) Monkie Kid Flower Fruit Mountain Adventure at Legoland Shanghai - China

A new indoor/outdoor flume ride will soon open at Legoland Shanghai, the anchor attraction of a land themed to the Lego Monkie Kid line of bricks introduced in 2020 and inspired by the legendary stories of the Monkey King and Journey to the West.

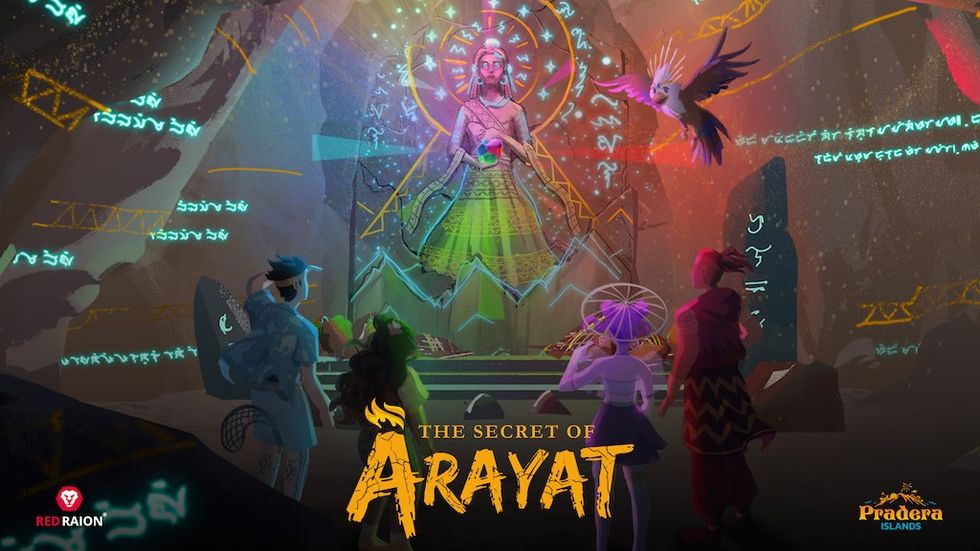

24) Secret of Arayat at Pradera Islands Park - the Philippines

An indoor dark ride experience custom-made for the park featuring new GCI content from Red Raion that will be projected on various screens built into the sets, as well as some fog screens, to help tell the story, with attraction design work by Lagotronics.

The attraction lies within a large volcano structure that sits in the middle of the lagoon at the center of the park.

Pradera Islands Park itself was delayed several times but finally opened in 2025, though the Secret of Arayat attraction is still listed as coming soon and expected to open sometime in 2026.

23) Guardians of the Hidden Chamber at Doha Quest - Qatar

A new “mini” dark ride experience from Sally Dark Rides is coming to Doha Quest.

Here, guests accidentally awaken an army of ancient “Guardians” tasked to protect the chamber that they’ve stumbled upon. Armed with “Fright Lights”, guests have to defend themselves from the angry supernatural horde.

Sally discussed the concept at IAAPA 2025 in Orlando as the “first-ever mini dark ride", saying that several attractions around the world desired a dark ride, but they really lacked the proper space to add one.

22) Rally Flaklypa at Hunderfossen Eventyrpark - Norway

A new themed dark ride is coming to Hunderfossen Eventyrpark this season from BoldMove Nation and featuring the all-new trackless ride vehicles from Rogue Rides.

This appears to be another attraction in the park to be themed around the characters of Norwegian creator Kjell Aukrust’s “Flaklypa” universe of characters, which may possibly tie into the Rally - From Paris to the Pyramids animated feature that was released in December 2025.

21) Barbie’s Flying Theater at Mattel Adventure Park - USA

This was part of our list last year, but the opening of the new park was delayed until 2026.

Barbie’s Flying Theater is promoted as one of the highlight attractions of the new Mattel Adventure Park under construction in Arizona. The designers were tasked with the rather strange concept of mixing the Queen of the Mattel toy empire, Barbie, with her own themed flying theater attraction.

While the concept could just end up as a horribly bad idea, I don’t think anyone quite anticipated how much of a hit the live-action Barbie film that came out in theaters in 2024 was going to be, either.

So, it would be best to reserve final judgment about Barbie’s Flying Theater until it actually opens.

20) Geheimnis des Drachentempels & Ravenmoore Academy at Freizeit-Land Geiselwind - Germany

A pair of themed attractions has been announced as opening at the park this year. Very little has been announced thus far, so I don’t know much about the story behind the “Secret of the Dragon Temple” attraction other than it is supposed to be an immersive tunnel attraction, themed as a boat ride that actually sits in water.

The water hides the motion base from view, allowing the vehicle to move forward, tilt, and even spin 360 degrees during the simulated experience.

The park will also open a second major attraction, a new dark ride called Ravenmoore Academy, which will take place within a large themed castle that is home to the magical Ravenmoor Academy, where nothing is as it seems.

19) SpongeBob’s Cravy Carnival Ride at Nickelodeon Play! - Istanbul

This is the third installation of the SpongeBob’s Crazy Carnival interactive dark ride attraction from Sally Dark Rides, following the first in Las Vegas in 2024 and a second version at the Land of Legends park in Turkey in 2025.

Riding in SpongeBob-themed cars, guests interact with a series of video screens to compete for the top score in a number of different carnival-style games before their finale encounter with the vile Plankton, who is still trying to steal the Krabby Patty secret formula.

18) Scooby-Doo Spooky Coaster at Warner Bros MovieWorld - Australia

After sitting closed for 2023, 2024, and most of 2025, Warner Bros. Movie World finally reopened the fully refurbished and renovated attraction just before Christmas 2025.

The updated version sought to mostly retain the same concept and storyline as the previous version, while enhancing the visuals and lighting effects throughout the indoor coaster experience.

The renovation will ensure that the popular Scooby-Doo Spooky Coaster endures for future generations of guests.

17) Galacticoaster at Legoland California & Florida - USA

A new themed indoor roller coaster experience is opening at the Legoland theme park in California in March, and has already opened in the Florida park in late February.

The indoor, controlled-spinning, tire-launched coaster ride system is a new project from ART Engineering that will feature a special-effects journey into space, in which riders are tasked with designing a customized spaceship they will launch into space to try to stop an incoming asteroid collision.

16) Star Trek: Wild Galaxy at Land of Legends - Turkey

This attraction was part of last year’s list, but failed to open in 2025. We still don’t know much about the attraction itself, as the park has only shared preview images of the themed queue experience.

This has confirmed that the new attraction is themed to the more kid-friendly Star Trek: Prodigy animated series from Nickelodeon rather than one of the many live-action Star Trek series or films.

It is worth mentioning that Star Trek-themed attractions are rare and are usually held to a fairly high bar when it comes to the theming within the experience, so we can only hope that the rumored space simulator experience will live up to the “Trek” reputation for a quality experience.

15) Delia’s Adventure at VidantaWorld's BON Luxury Theme Park - Mexico

The current timelines now say that this interesting new park will be ready to open in Mexico before the year’s end.

If it does, the park is supposed to have attractions that look to be very highly themed, though the best of all might be Delia’s Adventure, a mostly indoor dark ride that will use Mack Rides' unusual Inverted Power Coaster ride system that was first put to use at Europa-Park to create the Arthur dark ride.

Delia’s Adventure is thought to use a nearly identical track layout to Arthur, which means it should feature both slow dark-ride elements throughout the adventure and more thrilling coaster-like moments, including some outdoor high-speed track.

The unique nature of Mack’s Inverted Power Coaster is that not only is the speed of the trains fully controlled for the entire experience, able to speed up and slow down at will, but the rider’s cars are also programmed to rotate so that the guests will get the best views of the various dark ride scenes as they move throughout the attraction space.

14) SEVEN Al Hamra - Saudi Arabia

SEVEN is a new series of entertainment centers that are coming to locations throughout all of Saudi Arabia, each with a unique design, conceived by TAIT. While many sites are currently under construction, the Al Hamra location in Riyadh is considered the flagship and is now set to open before the end of the year.

Themed with an original, immersive. and futuristic storyline, the attraction will feature a number of highly themed environments and attractions.

This will include things like a Discovery Adventures center, indoor skydiving, indoor FlowRider surfing, Formula E indoor karting, and a unique, truly hubless Ferris Wheel ride from Intamin.

The location will also be the world premiere of the indoor Transformers-themed roller coaster experience, the first-ever S&S Axis Roller Coaster, where the cars can roll riders around the central X-Asis, offering a unique experience unlike anything else ever built.

13) Overal Vriendjes - De Tovertuinreis at Avonturenpark De Tovertuin - the Netherlands

A new dark ride creation for Avonturenpark De Tovertuin that will bring to life the animated adventures of Woezel and Pip and all their friends on an adventure through the Magic Garden on trackless Mystic Mover vehicles from ETF Ride Systems.

Some preview footage of the upcoming attraction has already been released on social media, ahead of the opening on 27 March.

12) Into the Deep at Six Flags Qiddiya City - Saudi Arabia

The newest Six Flags theme park took the time to really reach out into new territory and created a couple of custom dark ride experiences, along with creating its own IP, characters and storylines for these attractions.

Into the Deep is an interactive dark ride created in collaboration with Triotech that will take guests on an undersea adventure.

The ride system appears to be a little more aggressive than your standard slow-moving dark ride, as the vehicle will move at various speeds and spin rapidly to face different scenes, mostly populated by large projection screens that depict the action.

The world here is a bit dark, which helps the screens really pop with vibrant colors as they chase a large serpent-like beast for much of the journey into the mysterious depths.

11) Soarin’ Across America at Disney California Adventure & EPCOT - USA

Opening later this year, Disney has created a new American adventure-themed ride film for its Soarin’ flying theater attractions at Disney California Adventure and Epcot.

The Disney Soarin’ flying theater attractions are always hugely popular with guests, and I’d expect the House of the Mouse to go all out for this new ride-film that will launch in time to honor the nation’s 250th anniversary celebration.

10) Universal’s Kids Resort - USA

An interesting development that was not expected: Universal surprised everyone when it announced plans to build an entirely new mini theme park experience in Texas, featuring an on-site hotel and a new theme park designed just for kids.

The park will bring together a number of Universal’s most popular kid-friendly IPs in all-new ways, including lands themed to Shrek, Jurassic World, SpongeBob SquarePants, Trolls, Minions, and more.

9) SEAQuest: Legends of the Deep at SeaWorld Orlando - USA

While SeaWorld has never been known for its dark ride experiences, the park is looking to go all out this year with the new SEAQuest-themed attraction, which will also serve as the world premiere of an entirely new inverted dark ride system from Vekoma.

Thus far, SeaWorld Orlando has kept the exact details of the experience under wraps as it works to finish construction on a very large attraction building.

8) Kong x Godzilla: The Ride at Lotte World Adventure - South Korea

While this was being marketed on social media with a planned December 2025 opening, it does not appear to have opened just yet.

This major new attraction at Lotte World Adventure brings together a partnership between Legendary Entertainment and Sally Dark Rides to bring the first official “Monsterverse” theme park attraction to life.

Guests will join the forces of Monarch and embark on a mission into Hollow Earth, a hidden world full of giant creatures and titans.

The exact nature of the attraction has been kept under wraps, but the experience has been described as a multimedia dark ride in which guests are dropped into the middle of an epic battle in which Kong and Godzilla have teamed up to battle the forces that threaten them.

The attraction is supposed to feature ride vehicles, practical sets, projection mapping, and real-world effects.

7) Enchanted Greenhouse at Six Flags Qiddiya City - Saudi Arabia

A quite unusual dark ride from Six Flags Qiddiya City has been created here, and unlike Into the Deep, the action here is much more family-friendly.

This is a more traditional-style dark ride experience, as guests journey through an Enchanted Greenhouse designed by Jora Vision on trackless vehicles from ETF Rides. There is also an interactive system in use here from Alterface, as guests are asked to spray various creatures and plants with “dew” to help them grow.

Along the way, the riders unlock the mysteries of the greenhouse and find themselves shrunk to the size of an insect as they journey into the darker, more hidden sections of the greenhouse, before returning to the surface full-sized once again.

While Into the Deep features mostly projection screens, the Enchanted Greenhouse is full of practical sets and animatronics, with built-in projection screens for the interactive portions of the experience.

6) Fast & Furious: Hollywood Drift at Universal Studios Hollywood - USA

It is long past time for Universal’s original Hollywood theme park to get a major roller coaster. Thematically tied to Universal over the top extreme hot-rod film franchise, the Hollywood Drift roller coaster will be able to do things we’ve never really seen a coaster do before.

Riding up and down the studio’s steep hillside, these highly detailed cars will not only launch, loop, climb epic hills and dive down drops, but they will also be able to make controlled rotational spins, all while taking the coaster elements so that the sensations delivered will feel like nothing else we’ve ridden before.

The only downside is that beyond the queue, station and the coaster cars themselves, the rest of the coaster will be outside and exposed.

5) Rock ‘n Roller Coaster Starring The Muppets at Disney’s Hollywood Studios - USA

When Disney opted to remove the classic MuppetVision 4D attraction from the park to create a new Monsters, Inc.-themed land, many feared the worst: that the Muppets might vanish from the park entirely. Instead, the Muppets are moving to take over the park’s extremely popular Rock ‘n Roller Coaster indoor dark coaster attraction.

It was time for Disney to retire Aerosmith from the attraction anyway, as it already did in Paris, and rumor has it the company had been searching long and hard for a possible new replacement theme that would prove to be popular within the Disney Hollywood Studios theme park.

Given that Disney seems to be on a new roll with the Muppets with the return of an all-new version of The Muppet Show on Disney+ that just launched this year, I have high expectations to see what they can bring to the Rock ‘n Roller Coaster this summer.

4) Frozen Ever After at Disney Adventure World - France

A long time in the making, the launch of this new themed dark flume ride experience has been highly anticipated. Not just for the ride itself, it is arriving with a whole World of Frozen-themed land that also marks the expansion and rebranding of the entire Walt Disney Studios Paris theme park.

Upon the opening of World of Frozen, the park will take on the new identity going forward of Disney Adventure World, along with even more grand expansion plans to come.

3) Phantom Theater: Opening Nightmare at Kings Island - USA

At long last, the Phantom Theater is returning to Kings Island, with a new story and adventure for the next generation of guests.

The original Phantom Theater ran at the park from 1992 to 2002, featuring a custom-created cast of characters and a unique storyline that served as Kings Island’s own homage to Disney’s Haunted Mansion concept and even used a similar omni-mover style ride system.

After 24 long years, the Phantom is back to launch an all-new eerie production of fun sights and frights.

2) Nightflight Expedition at Dollywood - USA

This will be the premiere of Mack Rides new Rocking Boat ride system in North America, and I think it’s going to surprise a lot of people with the things that it can do.

Able to mimic the action of a roller coaster on a track and a boat ride running the rapids, all while running inside an enclosed themed dark ride style environment, plus add in the action and sensation of being on a flying theater as well.

NightFlight Expedition at Dollywood has set the stage for a real chance to stand out as the ultimate new ride experience for 2026, if all goes well.

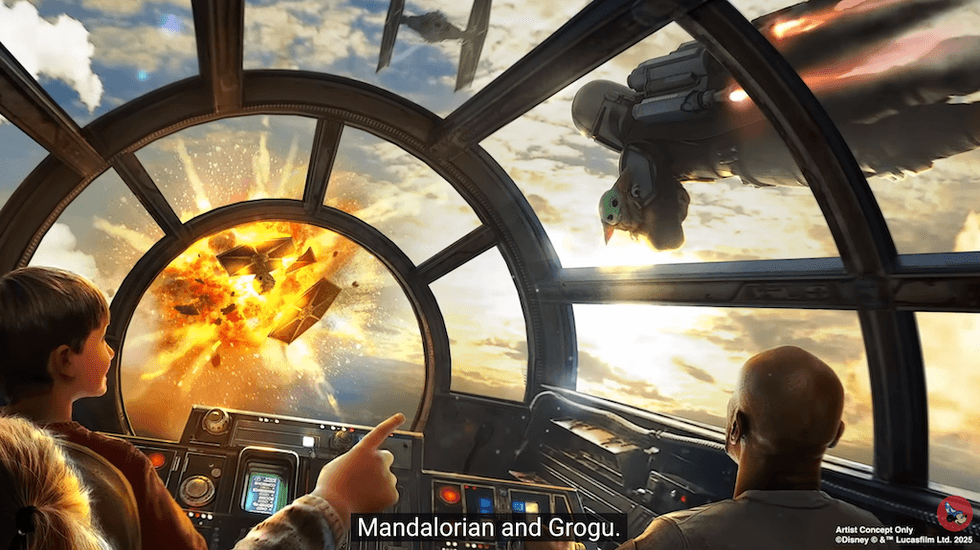

1) Millennium Falcon: Smuggler’s Run at Disneyland & Disney’s Hollywood Studios - USA

While this incredibly themed Star Wars attraction first opened in 2019, unfortunately, the experience of being inside what is essentially a live-action video game just never quite lived up to the hype.

Maybe it was the mission itself… or maybe it was the wonky control scheme that divided the task of flying the Millennium Falcon between two pilots instead of just one at the controls.

Either way, Disney is going to give the attraction a major do-over and relaunch it with an entirely new mission featuring none other than The Mandalorian and Grogu.

The New Mission will be available starting on May 22, 2026, the same day that the new Star Wars: The Mandalorian and Grogu film hits theaters, and is expected to feature expandable pathways you can choose during your flight, so that you can end up experiencing an entirely different plot each time you ride.

Death Eaters at Universal Orlando's Diagon Alley

Death Eaters at Universal Orlando's Diagon Alley  Hogwarts Castle

Hogwarts Castle