The first excerpt is available here, the second is available here, and the third is available here.

---

Adirondack Studios wasn’t a newcomer to working overseas.

In 1988, the company’s co-founder, Christopher Detmer, worked with American TV network NBC on the Seoul Winter Olympics, taking charge of technical production and VIP venue coordination.

Then, in the 90s, ADKS partnered with Universal on what became Universal Studios Japan.

But the company knew that in the deserts of the United Arab Emirates, the demand for entertainment was literally building fast, and ADKS wanted to be part of the solution.

Destinations in the desert

As chronicled in a previous article, ADKS’ roots in the Middle East date back to the creation of Magic Planet, an FEC conceptualized by Majid Al Futtaim that included a themed food court, rides and activities.

Advanced Animations, who was contracted to do the animatronics work, recommended ADKS for the majority of the scenic build.

Coincidentally, Hatem Farrah, CEO of the Dubai general contractor building Magic Planet, was scheduled to be in Boston, so ADKS invited him to their Glens Falls shop for a design charette.

That series of meetings sparked a relationship between Farrah and ADKS that led to not only more Magic Planets, but also a variety of other FEC and commercial real estate projects throughout the Middle East throughout the 1990s.

From the Middle East to Southeast Asia

Although work in the Middle East declined sharply in the early 2000s, ADKS was still testing other global frontiers for themed entertainment.

In 2009, Universal tapped ADKS to provide sets, props, special effects, and signage for the Revenge of the Mummy dark ride at their new Universal Studios Singapore park.

Puss in Boots Giant Journey at Universal SinagporeImage credit Dejiki

Puss in Boots Giant Journey at Universal SinagporeImage credit Dejiki

It was a unique opportunity for the ADKS Team to work with ITEC Entertainment (now a division of TAIT) on a reinterpretation of the Orlando attraction. The project enabled ADKS to open its own subsidiary in Singapore, Adirondack Asia Pte. Ltd., which still exists today.

Adirondack Asia developed a group of Singaporean and Malaysian subcontractors who it coached in the stringent construction and finishing requirements of Amusement Park Rides and Attractions.

These connections enabled ADK Asia to produce the show sets and props for Transformers: The Ride, Sesame Street Spaghetti Space Chase, and Puss in Boots’ Giant Journey, all at Universal Studios Singapore.

Transformers: The Ride

Transformers: The Ride

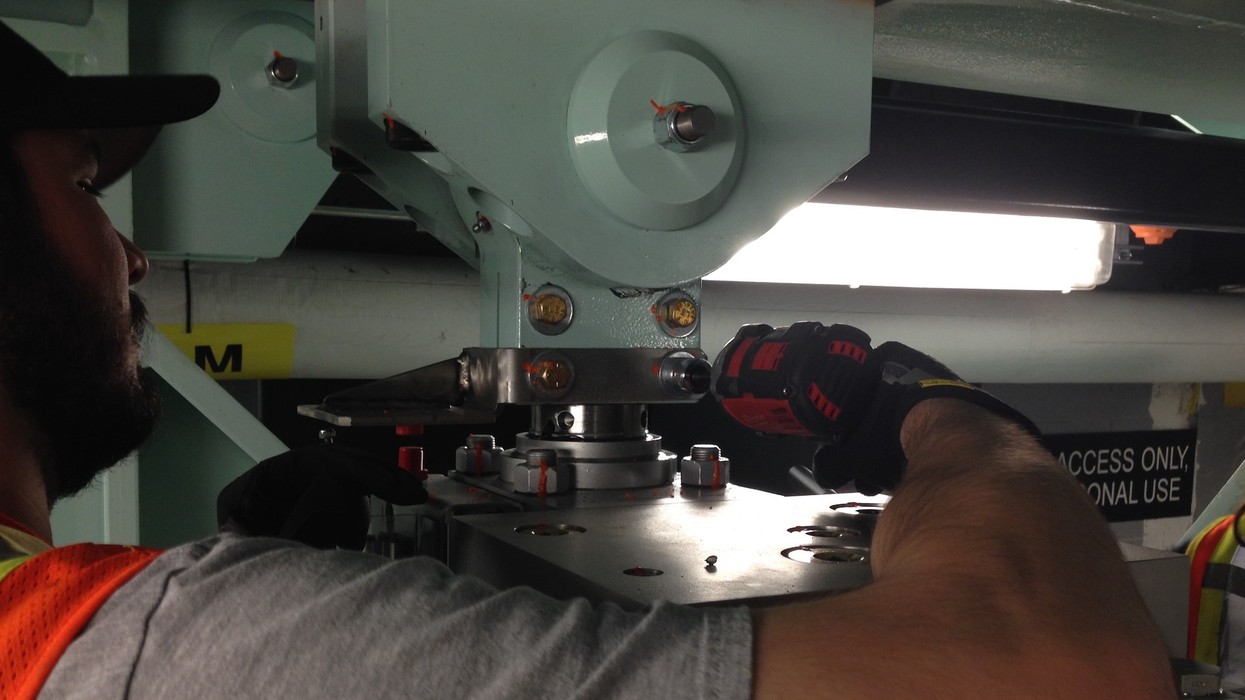

For the 3D projection surfaces in Transformers: The Ride, ADKS would need to apply Screen Goo 3D to the walls. It needed to be sprayed on in three very even coats on huge, toroidal screen surfaces.

Any miscalculation in quantity or repainting could add thousands of dollars to the budget. ADKS’ master painter and founding team member, Curtis Condon, came to the rescue, and he and his brother Tony wasted not a drop of Screen Goo.

After two years of construction and extensive test trials, Transformers: The Ride 3D opened to unanimous acclaim, and ADKS went on to fabricate subsequent versions in Hollywood and Orlando.

With the success of this attraction, ADKS proved they could take on and execute complete responsibilities for a logistically complicated theme park ride, and the company would go on to do just that for other rides and attractions across Asia-Pacific and around the world.

Doing it all…and then some

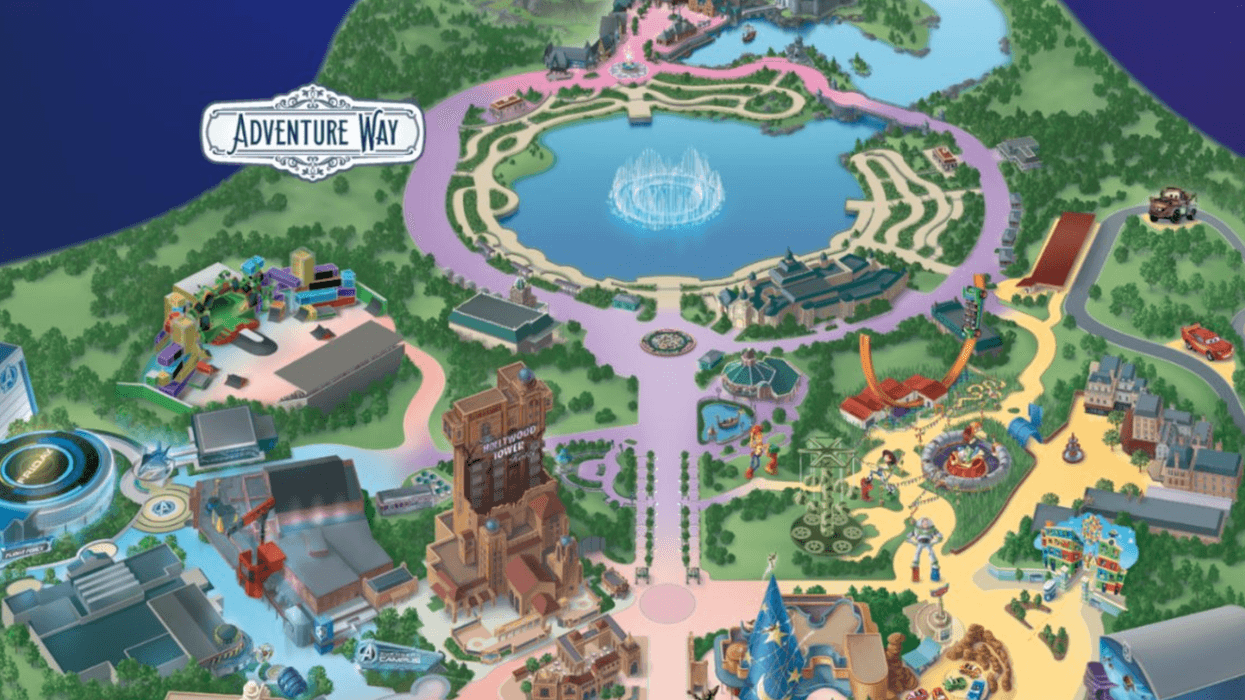

Motiongate was the start of ADKS taking on entire scopes of work for theme park developers – lighting, scenery, projection, animated figures and audio – all with the help of excellent collaborators.

Motiongate's How to Train Your Dragon area

Motiongate's How to Train Your Dragon area

The company was initially hired to develop designs for the Shrek’s Merry Fairy Tale Journey queue, ride and land, as well as area development for the How to Train Your Dragon zone.

Dubai Parks & Resorts, impressed with the quality of the work, soon added to ADKS’ plate the Camp Viking play area, the Swamp Celebration spin ride adjacent to Shrek, and the portals and murals for the Fountain of Dreams that welcomed visitors to the Dreamworks rides and attractions.

ADKS was now subcontracting and coordinating with lighting, audio, and media integrators, while still meeting design and fabrication commitments. It was a new level of expertise – delegating, supervising, and creating all at the same time – that would come increasingly handy in the years and projects that followed.

That expertise in the Middle East would lead to the establishment of Adirondack Studios Middle East, ADKS’ Dubai-based entity, in 2015.

Meanwhile, in Malaysia, Adirondack Studios was involved in the Genting SkyWorlds theme park, located in the country’s Genting Highlands.

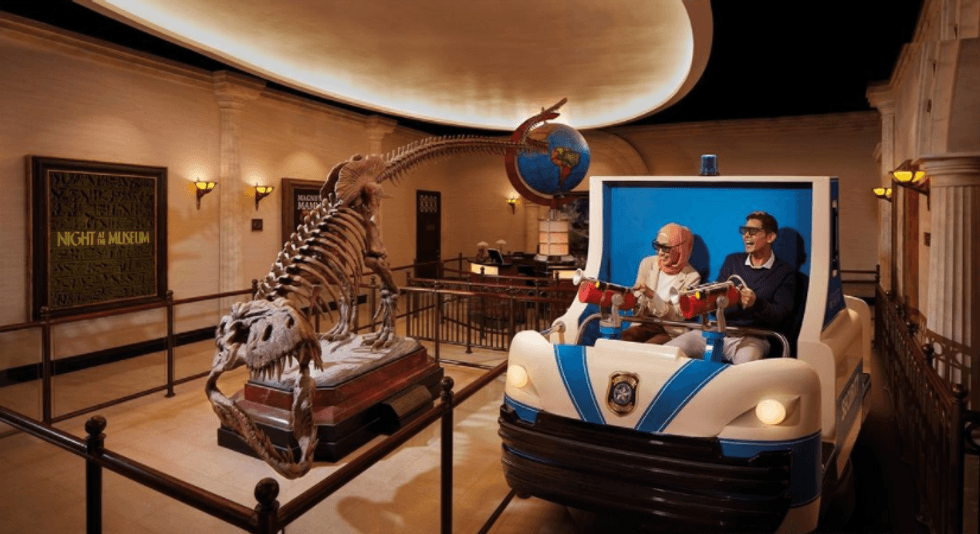

Over the seven-year design and production period, ADKS handled the park’s schematic design and design development as well as site supervision, providing rockwork, hand-painted murals, scenic paint and graphics, animated figures, props, lighting, sound and special effects, and audio/video and show control on multiple attractions.

Night at the Museum at Genting Skyworlds

Night at the Museum at Genting Skyworlds

These attractions included:

- Epic Voyage to Moonhaven, a flume dark ride

- Ice Age: Expedition Thin Ice, which transported guests back in time

- The Night at the Museum shooting dark ride

- Independence Day, a flying theater

- Invasion of the Planet of the Apes, an immersive 3D trackless dark ride.

Star turns

Theme parks weren’t the only places where Adirondack Studios was making a grand entrance.

In the 1990s, the Disney organization began adapting their catalog of animated movies for Broadway musicals, beginning with Beauty and the Beast. This success was followed by The Lion King, which opened in 1997 and continues to perform to packed houses around the globe.

But almost a decade would pass before ADKS finally had the opportunity to work with Disney Theatrical on an original project.

The company’s experience with Disney’s Theatricals began with fabrication of sets for the The Lion King tour and the scenery for their Broadway adaptation of Chitty Chitty Bang Bang. But ADKS’ big break came with Mary Poppins, one of the most anticipated musicals of the 2006 season.

Mary Poppins on Broadway - Banks House

Mary Poppins on Broadway - Banks House

A major task was building the Banks’ house, where much of the story takes place.

The production required a multilevel set. Its two floors and roof had to split into separate sections with the upstairs lifting free and lowering to either stage level or disappearing to the back of the stage, and the downstairs tracking forward and back depending on the scene.

ADKS worked with Hudson Scenic Studios and McLaren Engineering to develop the complicated mechanics. Ken Crosby, then VP of production, helped devise hidden lifts that sent Mary riding up the banister and shot the two children up from their bedroom to the rooftop to join in the big dance number.

While Mary Poppins had ADKS flying high on Broadway, The Little Mermaid took them under the sea – and presented equally complex challenges.

The company was not only responsible for creating Ariel’s magical underwater world, but also seamlessly transforming it into Prince Eric’s earthly abode in a matter of seconds.

To visualize the tug and drift of the ocean currents, ADKS developed a heated bending device to turn sheets of polycarbonate into undulating structural plastic to suggest waves and swirling water.

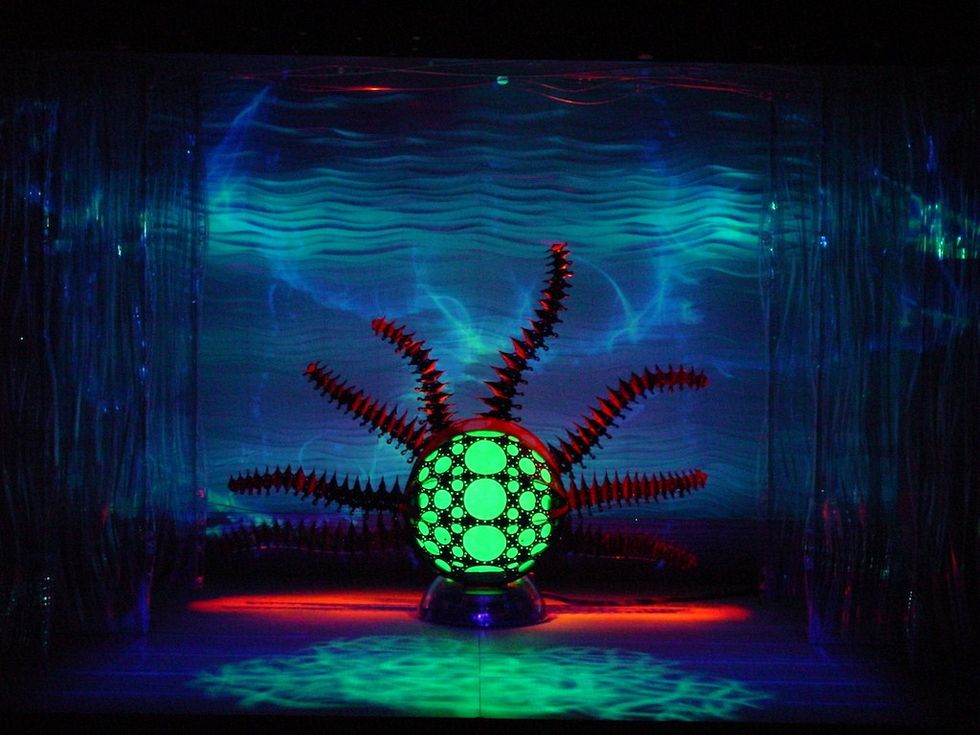

The Little Mermaid on Broadway - Ursula

The Little Mermaid on Broadway - Ursula

The biggest challenge, however, was Ursula. Her eight mechanical tentacles had to shoot out 18 feet onto the stage from the back of her “body” resting on a 6-foot disk without killing the two slimy eels dancing around her.

It was an effect that took ADKS’ fabricators many sleepless nights to create, but that resulted in a solution safe for performers and captivating for audiences.

After decades away from the Big Apple, ADKS was back on Broadway, having grown its upstate New York headquarters into a world-class union fabrication shop.

New challenges, new capabilities

Even though the curtain had risen on The Little Mermaid on Broadway, it wouldn’t be the last of ADKS’ encounters with Eric and Ariel.

At the turn of the 21st Century, Disney’s parks team began exploring outside vendors to expand the operator’s fabrication capacity. After visiting the company's Argyle facility to check out its capabilities, the Disney team liked what it saw.

They offered ADKS the opportunity to fabricate the Beast's castle, which would house the Be Our Guest Restaurant and overlook the new Fantasyland expansion. ADKS’ team learned a tremendous amount from the experience, which they were able to apply to subsequent Fantasyland attraction projects.

ADKS' next job was to build Eric’s castle for Under the Sea: The Journey of The Little Mermaid. The turrets for the castle were to be fabricated with fiberglass. The work order included pages and pages of highly detailed specifications over two inches thick.

Journey of The Little Mermaid - Eric's Castle

Journey of The Little Mermaid - Eric's Castle

Adirondack Studios prepared the turret molds but subcontracted the actual fabrication to a regional vendor they had used before. Just prior to installation, it was discovered that there were severe manufacturing flaws in the fiberglass.

Within days, ADKS put a plan in motion to replace all defective parts. The company turned around the work quickly at their own expense to Disney’s satisfaction. ADKS took the lesson as both a challenge and an opportunity.

The following year, they established an in-house fiber-reinforced polymer (FRP) department, one of the first fabrication companies in the world to do so.

Since then, the ADKS FRP team, led by Robert Willard since 2015 and still located in upstate New York, has produced wondrous creations for Brookfield Properties, Knott’s Berry Farm, San Francisco Opera, Meyerhoff Symphony Hall and world-renowned visual artists.

Knotts Berry Farm - Fiesta VillageImage credit Rabben Herman Design Office

Knotts Berry Farm - Fiesta VillageImage credit Rabben Herman Design Office

What could have been a relationship-killing disaster proved to be the beginning of a professional association between Disney Parks, Experiences & Products and Adirondack Studios that has spanned multiple decades and dozens of Thea Award-winning projects.

For its first 40 years, Adirondack Studios prided itself on devising new creative solutions, opening new lines of business, and discovering new areas of growth.

With additional capabilities in-house, iconic clients on the docket and burgeoning opportunities in the pipeline, what the future would hold was anyone’s guess. But ADKS was ready for it.

---

Stay tuned for a closer look at the projects, processes and people of Adirondack Studios Middle East, coming in March, followed by the final excerpt of “Fifty Years of Making A Scene” later this Spring.

Members of the Adirondack Studios team will be at the National Sports Forum in St. Louis, USA, from 22 to 25 February, the Themed Entertainment Association’s SATE Europe-Middle East Conference in Dubai from 24 to 28 March, and IAAPA Expo Middle East in Abu Dhabi from 30 March to 2 April. Attendees can schedule an appointment by email.

Puss in Boots Giant Journey at Universal SinagporeImage credit Dejiki

Puss in Boots Giant Journey at Universal SinagporeImage credit Dejiki Transformers: The Ride

Transformers: The Ride Motiongate's How to Train Your Dragon area

Motiongate's How to Train Your Dragon area Night at the Museum at Genting Skyworlds

Night at the Museum at Genting Skyworlds Mary Poppins on Broadway - Banks House

Mary Poppins on Broadway - Banks House The Little Mermaid on Broadway - Ursula

The Little Mermaid on Broadway - Ursula Journey of The Little Mermaid - Eric's Castle

Journey of The Little Mermaid - Eric's Castle Knotts Berry Farm - Fiesta VillageImage credit Rabben Herman Design Office

Knotts Berry Farm - Fiesta VillageImage credit Rabben Herman Design Office