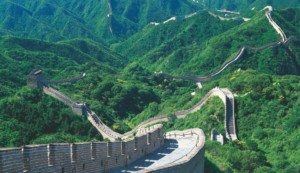

Thinking of getting involved in a project in China?

With continuing strong economic growth, all eyes are on China to strengthen global demand for leisure and entertainment and to provide the future base for the expansion of international concepts and brands. Yet the country still represents a challenging environment for newcomers, whether a developer, a supplier or an operator.

By Michael Collins and Natalia Bakhlina, LDP

By Michael Collins and Natalia Bakhlina, LDP

Hundreds of projects are being discussed, yet many of them will never make it to market or may fail in the first few years of operation. The most common mistakes are misjudging the market demand, the strength of the future competition and the perception of quality among the population. Large populations do not negate the need for considered viability testing and the honing of entertainment products to reflect and respond to the nuances of the market.

The attractions and leisure markets are expanding rapidly, but are still in their infancy with demand continuing to outstrip supply. For instance, the number of theme/ amusement parks per 1 million residents is significantly lower compared to more mature economies, yet the average visitation per park is on par with countries like the UK, Germany and Canada (see graph) suggesting a strong interest in parks.

The picture is similar for many types of leisure developments. With huge populations and strong domestic tourism, the demand/supply gap seems obvious, and the potential nearly unlimited. However only a fraction of developments end up succeeding with many struggling and failing shortly after opening. Below, we discuss some key challenges anyone who is looking to get involved in a new project in China should consider:

Lack of reliable information

In addition to the concept and its potential drawing power, the success of every leisure project is heavily dependent on the scale and nature of the resident and tourist markets it serves. You need to properly understand the demographics, income profile and lifestyles of the population to ensure the project is fit for market demand. While the ability to obtain reliable market information is key to evaluating any new project, in China getting a handle on this can be challenging. The official information tends to be thin, difficult to get and often unreliable. With this comes the necessity to be thorough and rigorous when it comes to research, and an experienced market consultant is able to get a proper grip on this through unrelenting research.

Income qualification

While main population centres are showing rapid growth of an emerging middle class, the Chinese market is still severely stratified. The Gini coefficient is estimated at around 0.47 versus for example 0.31 in South Korea and 0.34 in the UK (a higher coefficient means stronger income inequality). It is imperative not to be fooled by the sheer scale of the population and to income qualify the market to exclude those who would not have the discretionary spending power to be able to afford to visit or use the proposed project. In some cases, depending on the location within the country, income qualification may halve your available resident market; this could impact the project’s potential attendance and revenues, as well as the optimal size of the facility.

Simply taking out the population below poverty level based on official statistics is not sufficient – a thorough analysis is paramount to avoid overbuilding and unnecessarily risking capital. Like all other aspects of life and the economics in China, this is fluid and constantly changing, those who can’t afford a visit now, may be able to in five, ten or fifteen years. Business cases should take a long term view and allow for phasing and expansion in line with demographic and economic shifts.

Copycats

Risk of being replicated is one of the most common risks in China. An innovative and successful international concept (whether it is represented in China or not) is likely to see several copies popping up throughout the country. Kidzania, for example, which is not yet present in China, has seen multiple role play attractions opened with varying degrees of success and quality. In such a market, which is still quite unsophisticated and does not have the original attraction to compare with, the copycats can attract visits even when poorly executed and delivered at a lower quality level. The key for any new concept or brand entering the market is to make sure the superior product quality and service is delivered and brand and concept are fine tuned for the market.

Competition and quality. In addition to copycats, the overall level of competition from leisure and entertainment developments is getting stronger. A significant proportion of announced projects will not see their opening day but even a small percentage of planned developments coming to fruition means the competition in the next 5-10 years will be more severe than it is now. Disney, Universal, Six Flags and many other top world attraction operators are planning to enter the market shortly which will see a step change in quality. The quality of other projects, however, will vary. Despite a strong income qualification, a significant layer of the Chinese market is indeed getting wealthier, travels the world and as a result tends to respond well to high quality products. Good theme parks in China (Chimelong Paradise, OCT and Happy Valley parks, for example) already do well, whilst poor quality parks can struggle and even go bust. Ensuring that no corners are cut in the delivery and, importantly, operations of the project will be an integral part of success.

Different business culture

There are many articles covering this issue but we could not fail to mention that anyone entering a new market needs to understand nuances of the local business culture, working with authorities and details of the planning permission process. This subject clearly needs to be studied closely prior to any undertakings. This can not only impact the overall planning and development of a new project, but also the ongoing operations, and should be considered in long term business planning.

Address the challenges, and we see the Chinese market as representing huge opportunities for everyone. The market is maturing and getting wealthier, and the necessary income qualification is slowly getting less severe, meaning that each year more people have the sufficient level of disposable income to enjoy a day at an attraction. The markets (even when income qualified) are enormous, hungry for entertainment and are increasingly seeking quality products. A prudent approach combined with thorough research and analysis, a high quality concept, good delivery and strong operation are all key to success.

About LDP: LDP are a highly specialised limited liability partnership focussed on the viability and sustainability of leisure. LDP’s leisure experience includes visitor attractions, sports and entertainment venues, retail and entertainment, resorts and mixed use developments anchored by leisure. For new businesses LDP specialise in market analysis and feasibility work. For existing businesses LDP provide benchmarking driven reviews and assist with planning reinvestment or reengineering. LDP also value businesses for sale and prepare due diligence for buyers. For more information please contact info@leisuredevelopment.co.uk or visit www.leisuredevelopment.co.uk.

Images:

Graph: LDP

World of Joyland: Kind Courtesy shanghaiist.

Shanghai Disney Resort: Kind Courtesy Shanghai Disney

Other images: Kind Courtesy Travel China