Herschend has launched a $1.1 billion leveraged loan to help fund its acquisition of all of Palace Entertainment 's US theme parks and hotels.

The deal between Herschend and Palace Entertainment, Parques Reunidos’ US subsidiary, was announced in March of this year.

Herschend will acquire more than 20 Palace Entertainment attractions across 10 US states. These include seven theme parks, six water parks and six family entertainment centres (FECs).

Theme park properties in Palace Entertainment's portfolio include Kennywood and Dutch Wonderland in Pennsylvania, and Lake Compounce in Connecticut.

When the agreement was announced, Herschend CEO Andrew Wexler said: "We look forward to building upon the strong foundation that Palace Entertainment has created and welcoming these properties and hosts into the Herschend family of brands."

News of the $1.1bn loan was first reported by Bloomberg.

Herschend and Palace Entertainment deal

In a statement, credit rating agency S&P Global Ratings said Herschend plans to issue the loan and use cash from its balance sheet to fund the acquisition and refinance its existing debt facilities.

Herschend’s existing portfolio includes 29 theme parks, tourist attractions, and resorts in eight states and Canada.

The company's parks include Dollywood, Silver Dollar City and Kentucky Kingdom.

“Herschend is the ideal organization to lead Palace Entertainment’s unique properties,” John Reilly,chief executive officer of Palace Entertainment, said in March.

“Herschend is best in class in providing a high-quality guest experience within its parks. Palace Entertainment’s team members and its parks are in great hands as we make this transition.”

The deal is a major milestone for both companies, as Herschend works on its expansion in family entertainment and hospitality, while Parques Reunidos focuses on its core market in Europe.

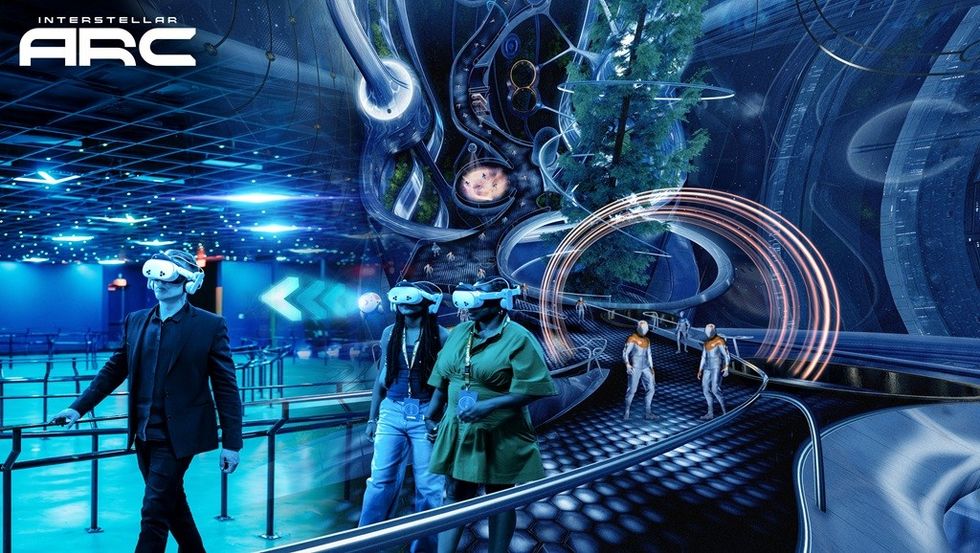

Images courtesy of Herschend and Parques Reunidos