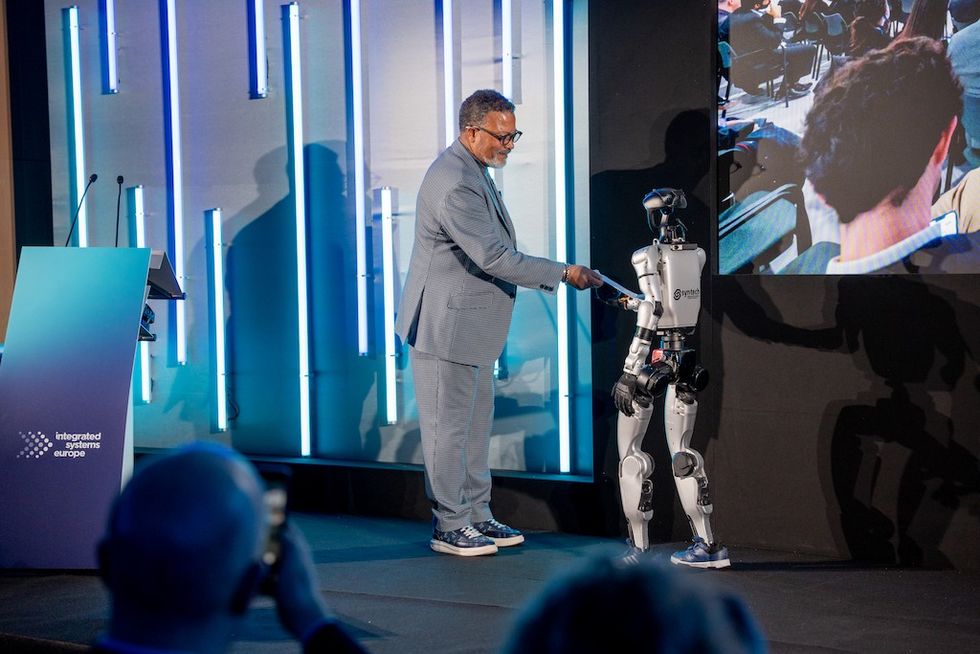

Blackman with a robot friend at ISE 2026

Blackman with a robot friend at ISE 2026

"Over four extraordinary days, we celebrated groundbreaking technology, ignited bold ideas, forged lasting connections, and set new benchmarks for our industry. What excites me most is the creativity, energy, and diversity of our exhibitors and partners, and the unwavering dedication of the ISE team that makes it all possible."

For the first time, there was a drone show in the evening for ISE attendees.

The performance on Tuesday evening featured 600 drones, along with a live performance from opera singer Anna Slizinova, accompanied by a violinist and a pianist.

Image credit Michiel Ton

Image credit Michiel Ton

On Wednesday evening, the South Access screen played Jeroen van der Most’s piece ‘Excel Heart’. The show was sponsored by Christie, which had its name in the sky as part of the show.

Highlights from the educational programme

Cirque du Soleil shared insights into Alizé, its first resident show in Europe, which opened in November. Moderated by Todd Staszko, editor at MONDO-DR, the session was led by Simon Lachance, director of technical design at Cirque du Soleil.

Designing the show for an existing, relatively small theatre posed unique technical challenges for the team. From the outset, the idea of making performers appear and disappear on stage was central to the production.

“You want the show to be unique, you want it to have an edge that will make it run for many years,” said Lachance. The result is what Cirque describes as “the meeting of new magic and new circus”, developed with illusion specialists Magie Nouvelle and a wide creative and technical team.

Lachance highlighted the complexity of aligning lighting, tracking, costume, audio, technical elements and circus, describing the process as “doing 5 shows in one”.

Reliability emerged as a key theme, not just for the audience experience, but for performer safety. With artists on stage performing expert circus skills that require extreme concentration, if a lighting or video element of production fails or isn’t in sync, it can be dangerous for the performers.

For this, Cirque du Soleil prioritised ultra-precise lighting and screens capable of working in very low light. During the creation of the show, the team also required systems that could evolve rapidly during rehearsals, making AV usability and UI increasingly important to the creative process.

To achieve the feat of making performers appear and disappear on stage, Cirque du Soleil spent more than two years developing and refining the tech through extensive R&D and preproduction testing in Montreal.

Trusted vendor partnerships were essential, including custom tracking and playback solutions from VYV, over 20 projectors from Absen, and custom LED systems from Theatrixx driven by Brompton Technology processing.

Despite the amount of technology involved in creating the world of Alizé, much of it is deliberately unseen by the audience. “We are investing a lot in things that people don’t see," said Lachance.

That invisible effort is acknowledged nightly on stage, with the technical team joining performers for the bows, reflecting how Alizé blurs the lines between backstage and onstage and how central technology has become to Cirque du Soleil's creative process.

Creative keynote: performance-led projection mapping at Casa Batlló

One of the most compelling creative sessions at ISE explored how projection mapping can move beyond surface spectacle into a performance-led, research-driven artistic practice.

In Behind the Façade: Building a Performance-led Mapping at Casa Batlló, Matt Clark, principal artist at United Visual Artists (UVA), unpacked the studio’s Hidden Order project for Casa Batlló, tracing its journey from initial observation to final on-site delivery.

Clark framed the project not as a conventional architectural mapping, but as an extension of UVA’s roots in performance design. Rather than starting with content, the team began by “reading” the building itself.

Casa Batlló, Clark explained, was approached as a living body—composed of organs, rhythms and tensions—reflecting Antoni Gaudí’s deliberately open-ended architectural language. That ambiguity became an invitation rather than a constraint, allowing multiple interpretations to coexist.

The project evolved through a close dialogue between physical performance and digital systems.

Dancer Fukiko Takase’s live performance inside the building became a foundational reference, later translated into a digital avatar through motion capture, TouchDesigner workflows and bespoke content systems developed back in London.

Clark highlighted the importance of flexibility throughout the process, from cloning and lighting tools to displacement techniques that kept the digital layer responsive to the building’s irregular geometry.

Throughout the session, Clark returned to a recurring theme: the need to push beyond content production towards systems that support coexistence—between architecture and body, heritage and technology, permanence and ephemerality.

In that sense, the Casa Batlló project was presented less as a one-off installation and more as a study in how performance, exhibition and research can converge in the digital age.

Sustainability: from seed to strategy

The session Sustainability: From Seed to Strategy, hosted as part of AVIXA Xchange LIVE, brought together voices from across the AV and experience design ecosystem to discuss how sustainability can move from principle to practice.

Moderated within the framework of the AVIXA Sustainability Advisory Group, the panel featured Thomas Serbruyns, vice president of strategy and sustainability at Barco, alongside Carolina Sosa of Integración AV and Ray Kent of Harvey Marshall Berling Associates. It was chaired by Kelly Bousman from AVI-SPL.

Serbruyns outlined Barco’s long-term sustainability approach, which began in 2015 with a deliberately pragmatic mindset.

Instead of targets, he argued organisations should focus on three steps: engaging stakeholders early, measuring what matters in the company’s footprint, and building teams by identifying sustainability “champions” across departments.

Measurement, Serbruyns noted, has become far more accessible in recent years. Where sustainability data once required costly external consultancy, companies can now track and manage performance internally.

At Barco, product energy consumption during use remains the largest contributor to environmental impact, underscoring the need for customer collaboration as a critical starting point. Supplier-side data, by contrast, requires more mature systems and longer-term partnerships.

Serbruyns also described Barco’s internal equal-scoring model, where sustainability performance is assessed alongside cost and R&D priorities.

Sustainability, he emphasised, should not be treated as a constraint, but as a strategic design parameter—one that informs how products are developed, deployed and ultimately sustained over time.

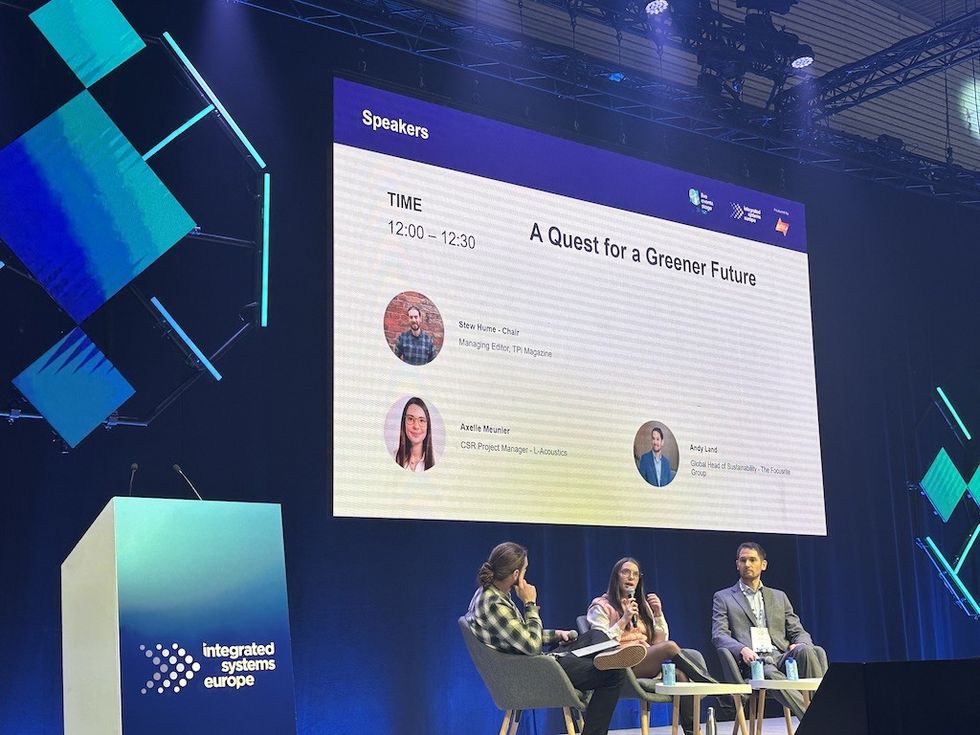

A quest for a greener future

Speaking on the Live Events Stage, Axelle Meunier, CSR Project Manager at L-Acoustics, emphasised that meaningful sustainability begins with people rather than metrics.

Engagement, she argued, must start internally—with employees—before extending to wider stakeholders.

Establishing reliable data is the next critical step: understanding a company’s footprint and baseline performance enables informed action.

Meunier also highlighted L-Acoustics’ collaboration with French government-backed projects to collect sector-wide data and identify measurable impact pathways, reinforcing that the sustainability strategy must be evidence-led and collaborative.

The advancing world of AV on high-end cruise ships

At ISE’s On the High Seas session, industry leaders examined how audiovisual technology is reshaping entertainment and media delivery on next-generation cruise ships.

Speakers, including Paul Byrne and Matt DeJong, highlighted the escalating demand for AV systems that rival those in land-based theatres and cultural venues, as cruise lines innovate to deliver immersive visual and sound experiences at sea.

Modern vessels such as Star of the Seas now deploy fully decentralised, ship-wide broadcast and AV networks that seamlessly route high-resolution video, audio, and data across more than 30 performance spaces.

This integrated infrastructure supports large-scale multimedia shows, live performance environments and real-time production workflows—bringing a new era of onboard entertainment that blends theatre-calibre technology with the unique challenges of maritime operation.

Unlocking APAC

APAC is one of the fastest-growing AV regions, offering growth opportunities for many companies.

June Ko, executive director of InfoComm Asia, emphasised that Asia Pacific comprises many countries that are maturing at very different rates. So it’s vital to research each country and understand if your product or offering suits that market first.

“Business doesn’t just reside in a piece of paper”, she explained. Understanding the culture is vital to establishing relationships that make contracts come to life. Laila Jede Jensen, CEO & founder of Zenova ApS, agreed with Ko, saying that trust and reputation are everything in the APAC region.

When asked how European companies can enter the market, Ko highlighted that the InfoComm shows are a great starting point. They ensure that the people you meet are of the right calibre who understand how business is done locally.

At each show, you can begin to establish the right relationships for specific markets; that’s why they have separate shows for different regions.

Bharath Kumar Allur, president APAC at Kramer, explained that to work in the region, you must have a partner in the area. For regions like India, customer service is vital, so it’s important to have good partners.

All panellists agreed that there are many opportunities in the APAC region at the moment, especially in the growing experiential and museum sectors. Ko explained that, with global instability, you have to diversify your business risks.

“APAC is the largest growing market right now. It is the opportunity," said Ko. "Think global, but act local”.

Tech tours

Trison at Barcelona Aquarium

One of the standout tech tours during ISE took delegates to L’Aquàrium de Barcelona, where Trison showcased how digital systems can be integrated into a sensitive, experience-led environment.

The visit was led by ISE staff alongside Alfonso Alonso, business development manager at Trison, who outlined the company’s philosophy of aligning technology with space, narrative and audience needs.

Alonso emphasised that each venue requires a tailored solution. “Every journey has different solutions,” he explained, describing Trison’s role as finding the right balance between environment, experience and product.

At an aquarium, this balance becomes particularly critical. With around 60% of visitors being children, usability and clarity are central to the design approach. At the same time, technology must remain subordinate to both animal welfare and content authenticity.

“We cannot cheat the content,” Alonso noted, stressing that screens and interactive displays should complement, not dominate, the storytelling.

Digital upgrades at the aquarium have largely replaced traditional static information boards with responsive, easy-to-use screens designed for younger audiences.

Lighting levels, screen placement and brightness are carefully calibrated to avoid disturbing marine life, reinforcing the idea that technology here is a supporting layer rather than the main character.

Looking ahead, Alonso hinted at Trison’s next major project in North Africa. This will differ significantly in scale and context from the aquarium model, underscoring the need for digital strategies to adapt to local conditions and audience profiles.

SABDA and the architecture of immersive wellbeing

The second technical tour offered a markedly different perspective on immersive design, taking delegates to SABDA, where co-founder Juliet Eve Levine and her team presented a space built around meditation and healing rather than spectacle.

Levine described SABDA as an immersive environment designed to remove distraction and foreground deep listening. Unlike attraction-based installations focused on visual intensity, the immersive room prioritises calm, presence and sensory coherence.

Moving images and subtle video content are projected across the surrounding walls using Panasonic projectors, creating a seamless visual envelope that supports—not overwhelms—the meditative experience.

The session itself was divided into two parts. Delegates first experienced a guided deep-listening sequence within the projection-mapped environment, followed by a structured meditation session.

The intention, Levine explained, is to use immersive technology as a facilitator of introspection rather than as a stimulant.

SABDA has established a strong following in Barcelona and is now exploring expansion into new markets, suggesting that immersive design is finding applications beyond entertainment and retail—into wellness, mental health and contemplative cultural spaces.

Innovation on the show floor at ISE 2026

On the trade show floor, Losonnante was exhibiting its Whisper Box, an immersive bone-conduction sound device that won first place in the creative technology category at the blooloop Innovation Awards 2025.

The system works by having the sound travel through vibrations directly through the bones to the inner ear. On display, the team were showcasing the Whisper Desk, as well as variants that can be placed on a wall, and a chair that transmits vibrations when sat on.

Meanwhile, Modulo Pi was showcasing its latest media server, Modulo Kinetic V7. This is the most powerful and flexible media server Modulo Pi has released, and visitors could see its capabilities through an immersive, interactive projection on the booth.

V7 is already being rolled out, with its first installation set to open soon, where the powerful tech has enabled automatic blending and warping for projection mapping.

Listen Technologies and its strategic partner Ampetronic previewed new Auri products, including an Auri Neck Loop. This neck loop lanyard provides an optimised listening experience for end users with telecoil (t-coil) equipped hearing aids or cochlear implants.

The company also previewed ListenWIFI 3.5, the latest version of the audio-over-Wi-Fi assistive listening solution, which lets end users access venue audio using their own smartphones or a dedicated receiver.

ListenWIFI was recently used at the UK Pavilion at Expo 2025 Osaka and helped to optimise the audio experience for all visitors. It filtered out ambient noise so visitors could hear the audio clearly. Plus, visitors with Bluetooth-enabled hearing aids or cochlear implants could stream audio from their smartphones directly to their devices.

Projection innovation

Elsewhere, attendees could see the new Korus series projectors from Christie with an interactive mapping display on masks. The new series provides 4K UHD+ clarity in a compact, light design. It has eight different lenses, including a UST lens for tight-space installations, allowing the projector to be placed close to the wall.

There was more projection mapping on the booth, as an M 4K25 RGB 3DLP pure laser projector delivered colourful artwork onto a large elephant. The Christie Jazz Series 1DLP projectors set the scene behind the elephant, showcasing how easy it is to mix technologies to create an engaging effect.

The team also previewed the new XP Series LED that will be launched at InfoComm later this year.

Featuring precise colour accuracy, it provides unmatched visuals in both low-light and high-brightness environments, such as dark rides and immersive attractions.

L-Acoustics showcased its products across two booths and in an audio demo room, where live music demonstrated their versatility. Attendees could experience a variety of L-Acoustics products, including the X Series, A Series, KS21, LA1.16i, LA7.16i, as well as L-ISA Immersive, Hyperreal, DJ, and Ambiance technologies.

The company also highlighted that its L-ISA Studio has been updated to version 2026.1.

The L-ISA Studio is free to download, and the new update improves interoperability with third-party applications and hardware via the ADM OSC Protocol for smoother, cross-platform workflows.

Enabling immersive experiences

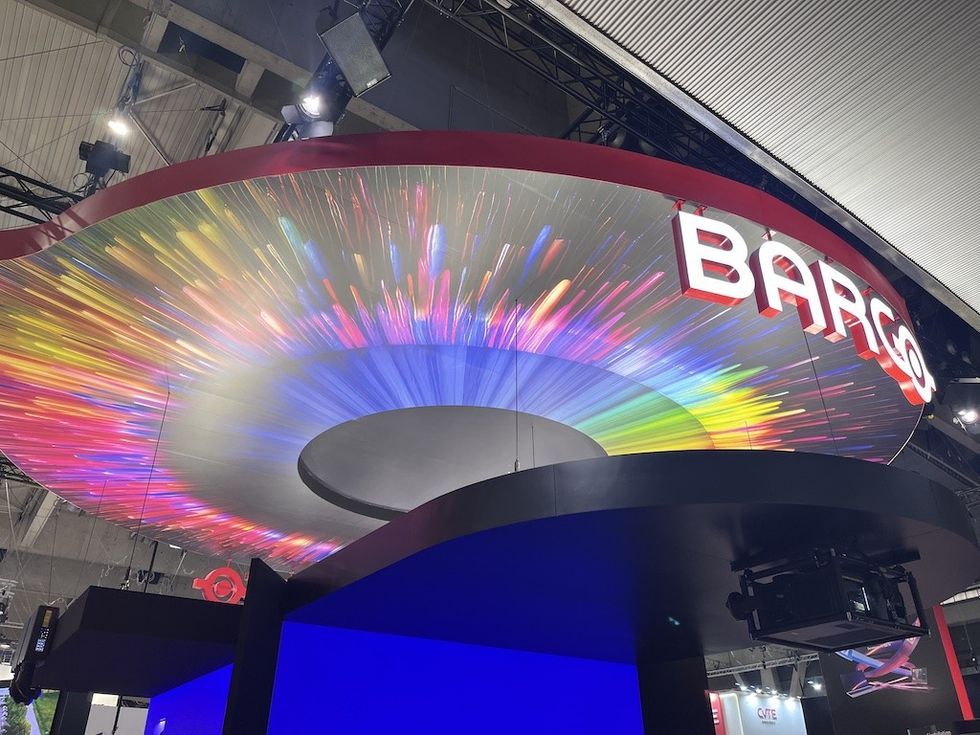

Barco introduced three new RGB models to its QDX platform during ISE 2026. This means the platform is now a fully rounded solution for themed entertainment and high-profile installations, with both RGB and laser phosphor options.

The booth also showcased a prototype of a new snorkel lens for Barco’s I600 single-chip projection platform. The projector is designed to offer exceptional colour fidelity and 4K UHD resolution.

Attendees could also experience a dual 3D experience on Barco’s TruePix TP1.2‑I LED screen. Using its Infinipix IND processor, the screen showed two videos simultaneously. 3D glasses showed viewers only one video at a time, allowing two different experiences to occur simultaneously.

Attendees could also explore Barco’s new camera-based auto-alignment tool for immersive experiences.

Co-developed with Scalable Display Technologies, the fully integrated software solution uses camera-guided calibration to automatically align, warp, and blend images from multiple projectors into one seamless display.

At ISE 2026, HIVE returned under the theme Ecosystem Evolution, showcasing how its connected SDM media server platform is expanding beyond traditional playback into fully integrated AV-over-IP workflows.

New third-party integrations were a major focus on the stand, including Dante, Q-SYS and VIOSO, alongside continued development around SMPTE 2110, HDR and advanced pixel-mapping tools.

One of the most talked-about demonstrations was Pollen Hunt, an interactive game created in Unreal Engine and deployed on the stand to demonstrate its flagship Beeblade Nexus media engine within an SMPTE 2110 workflow.

Conversations throughout the week pointed to strong interest in Beesync – HIVE’s synchronisation tool for keeping multiple video outputs perfectly in time – particularly for large-scale LED projects, where precise synchronisation is becoming increasingly critical as walls grow in size and resolution.

HIVE also won Best Medium Stand Design for the second consecutive year, chosen from more than 1,700 exhibitors for its creative execution and distinctive nature-led theme.

Easy control

At ISE 2026, Beckhoff showcased how to use its open, modular automation platform to create unique installations. All technical systems can be integrated into one single platform through various interfaces, from audio and video systems to lighting and stage technology.

Beckhoff already offers more than 20 different interfaces here, including Pixera, sACN, DMX, ArtNet, QSC, and various others. This is now being expanded to include Riedel Communications and SMODE projection systems.

System integrators can now easily integrate Beckhoff's open PC- and EtherCAT-based control technology components into the Riedel system, and vice versa. Therefore, Beckhoff supports the RRCS protocol from Riedel in TwinCAT with the TwinCAT 3 Function TF6310.

This enables communication with Riedel Artist and Bolero systems, as well as the use of Riedel smart panels.

To enhance integration across lighting, audio, and media workflows, Beckhoff showcased direct, seamless connectivity between its modular I/O terminal system and leading entertainment show-control software—including QSC, Châtaigne, TouchDesigner, and Stage Precision.

For kinetic effects and stage technology, Beckhoff presented a cost- and function-optimised economy drive system comprising AM1000 synchronous servomotors, AX1000 servo drives, and AF1000 variable-frequency drives.

Beyond hardware, Beckhoff is addressing productivity across the entire automation lifecycle with TwinCAT 3 CoAgent, an intelligent AI assistant that combines the latest generative AI models with specialised AI agents, transforming complex engineering and operational tasks into intuitive, natural-language dialogues.

Powering immersion

AV Stumpfl unveiled its powerful PIXERA four GEN2 media server, designed for demanding real-time graphics, XR/AR broadcasts, and virtual production. It also introduced the PIXERA four GEN2 RS.

This media server platform is optimised for rental and staging projects that require ruggedness and reliability.

Digital Projection celebrated its 30th anniversary by showcasing its high-brightness laser projectors designed for large-scale, high-impact environments. The company also highlighted its advanced 3-chip DLP solutions that deliver exceptional colour accuracy and contrast.

At ISE 2026, Disguise invited visitors to experience firsthand how its end-to-end solution of software, hardware, and services can drive deeper audience connection across live events, immersive spaces, and stadium environments.

Activations included an immersive tunnel on the booth, powered by the GX 3+ server and featuring reactive Notch content created by Disguise's Creative Services team, controllable via a custom Experience Panel.

Disguise showcased its end-to-end stadium and arena solutions with an interactive basketball activation where participants chose avatars and shot as many hoops as possible within a time limit, with real-time results on a digital leaderboard.

Building on its partnership with ASB GlassFloor, the activation featured a digital court to demonstrate multi-surface interactive visuals.

Demo pods showcased Disguise's software-only solution, X1, for access to Designer without a media server; ideal for installations. They also previewed updated features in the projection mapping tool, Mapping Matter, to aid projector calibration, and a first look at the new Looks feature in Designer, for non-technical users to work with templates.

Visitors could also discover Disguise's AI innovations, including the AI workflow assistant Ask AId3n to accelerate production and integrations with third-party systems, such as show control with Smart Monkeys, to streamline workflows.

AV solutions

Pharos Architectural Controls highlighted its lighting control platforms, designed for permanent installations across attractions and themed environments.

The company showcased its Designer system, which enables complex, preprogrammed show control using built-in time clocks and a rule-based trigger engine to adjust lighting behaviour throughout the day, including integration with external data such as tide times and moon phases.

Alongside this, Pharos presented Expert, a compact, standalone lighting controller designed for simpler applications such as facade lighting, offering a more accessible entry point while retaining reliability and control.

Visual Productions BV showcased its new NetPanel solution, a range of wall-mounted user interfaces for flexible lighting control. With this, guests and staff can easily adjust lighting colour, temperature and brightness through a sleek, intuitive interface, designed as a solution for hotels, restaurants, bars and social entertainment venues.

VIOSO showcased its auto-calibration for multi-projector setups and demonstrated its new EXAPLAN software.

This allows museum designers, architects, and planners to project their designs at 1:1 scale and walk around them in real space, simplifying the planning process and drastically reducing the time it takes to conceptualise new attractions.

Also central to the booth was the new EXAPLAY 3 media server. Designed specifically for installations such as museums and attractions, it offers a simplified, cost-effective alternative to expensive media servers, which are not always needed.

Intelligent platforms

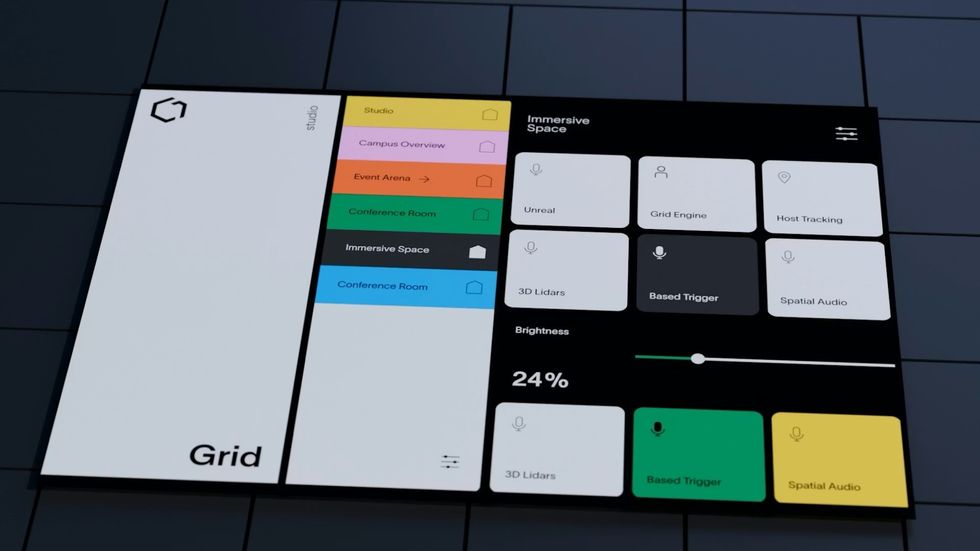

The Stage Precision team showcased SP Grid, a control platform designed to shape the next era of immersive AVLM and interactive environments. It is a unified platform for real-time control and 3D data management.

As a spatially intelligent platform, it can visualise data in the actual environment through 3D simulation.

Yamaha launched its new installed sound solution ecosystem at ISE 2026 in Barcelona, with new DSPs, power amplifiers, and control solutions.

The new lineup includes the DME5 and DME3 digital signal processors, which complement the existing DME7, eight new XMS series power amplifiers, and updates to its human interface devices, such as wall panels, touch panels, and the software ecosystem.

BrightSign brought its latest digital signage innovations to life at ISE 2026, through interactive, real‑world intelligent signage experiences spanning retail, QSR, transportation, and corporate environments.

BrightSign also highlighted its players' ability to power AI at the edge thanks to built-in Neural Processing Units (NPUs) that run powerful AI applications directly on the player.

Real-time motion, object and gaze detection, and audience measurement applications powered interactive, personalised experiences that could adapt to audience behaviour.

Additionally, BrightSign showcased its high‑performance Series 6 media players. This included BrightSign XD6, HD6, and XS6 - designed for enhanced performance and flexibility while supporting the versatility and reliability synonymous with the BrightSign name.

AI for attractions

For PPDS (Philips Professional Displays), ISE 2026 was an opportunity to introduce its latest hardware and software solutions, which in 2026 placed a heavy emphasis on AI.

A range of AI-ready Philips displays, including the brand-new Philips Signage 5000 Series and the ‘back to basics’ Philips Signage 2000 Series, were among the company’s headline product announcements.

Visitors to the booth could become part of the exhibition and performance, with their faces photographed in front of displays and then, using AI software, transformed into the next star player of FC Barcelona, standing victorious on stage or even floating through space (see image).

The power, potential, capabilities, and enjoyment offered by AI were clearly showcased, with PPDS explaining its potential for a wide range of settings, including sports stadiums, museums, theme parks, and other public venues.

EM Acoustics debuted the CS15 and CS18 cardioid subwoofers at ISE this year. Both products were inspired by requests from professionals to meet the demands of the installation, theatre and live event markets.

Each CS subwoofer requires only a single amplifier channel, and its cardioid performance is generated by a highly advanced passive crossover network rather than bandpass group delay.

Engaging tech

Avolites also celebrated its 50th anniversary at the show. The team showed off its one-of-a-kind, 24-carat gold-plated D3-010 console. Anyone can collect Gold Tokens throughout the year by completing Avolites actions.

Top-scoring competitors will be entered into a draw live at the PLASA Show in London in September, with one contestant taking home the Golden Console.

At the Panasonic press briefing, Yosuke Adachi, CEO of Panasonic projector & displays corporation, explained that MEVIK allows for a “deeper immersion and bolder creative vision” backed by Panasonic’s reliability.

The company also announced the PT-HTQ20 projector, which delivers deeper immersion with VIVID Prime and colour reproduction equivalent to Rec.2020.

Looking Glass Factory was showcasing its new 86-inch Hololuminescent Display, a human-scale holographic digital signage system designed to bring three-dimensional content into real-world environments.

Using an integrated holographic optical layer, the Hololuminescent Display creates the illusion of depth and physical presence without the need for headsets, offering an eye-catching solution suited for retail activations and immersive museum exhibits.

ISE 2027 will take place from 2 - 5 February 2027 in Barcelona.

Blackman with a robot friend at ISE 2026

Blackman with a robot friend at ISE 2026 Image credit Michiel Ton

Image credit Michiel Ton

Images provided courtesy of High Note Events and Experiential Media Group

Images provided courtesy of High Note Events and Experiential Media Group Images provided courtesy of High Note Events and Experiential Media Group

Images provided courtesy of High Note Events and Experiential Media Group