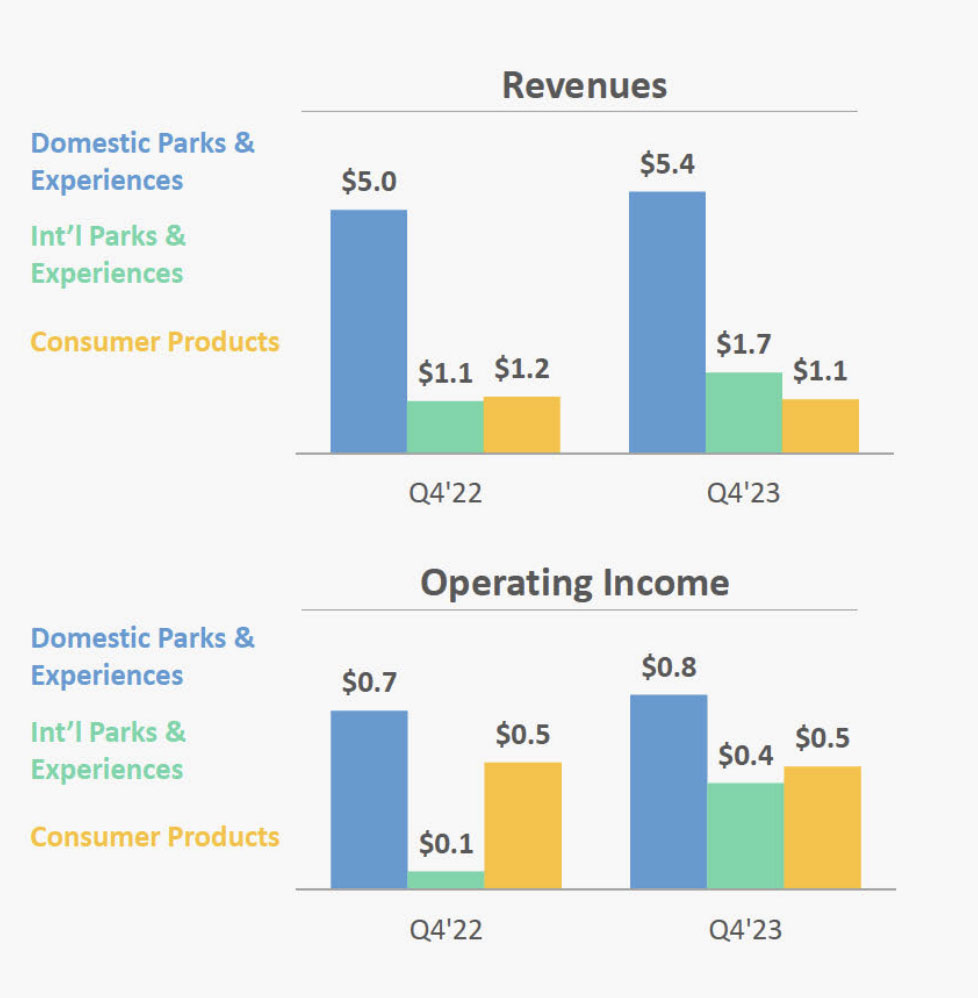

Disney’s Q4 results showed double digit growth, both for the quarter and full year, for the Parks and Experiences segment. Operating income was up 31% for Q4 and 23% for the full year.

Commenting on the results, Disney’s Chief Executive Officer, Bob Iger said that the company is now moving into a growth phase after some aggressive cost management:

“Our progress has allowed us to move beyond this period of fixing and begin building our businesses again.

“…we are focusing on four key building opportunities that will be central to our success:”

- Achieving significant and sustained profitability in our streaming business

- Building ESPN into the preeminent digital sports platform

- Improving the output and economics of our film studios

- Turbocharging growth in our Experiences business

Strong performance from Parks and Experiences

The growth delivered by the Experiences segment was across the board, with domestic and international parks and consumer products all contributing.

However, Walt Disney World’s operating income was negatively impacted by:

- a comparison to the prior year which included the 50th birthday celebrations

- inflationary pressures

- and accelerated depreciation resulting from the closure of Star Wars: Galactic Starcruiser

Iger noted that, “even in the case of Walt Disney World, where we have a tough comparison to the prior year, when you look at this year’s numbers compared to pre-pandemic levels in fiscal ’19, we have seen growth in revenue and operating income of over 25 and 30%, respectively.”

A strong return for Iger

Having returned to the helm a year ago, Iger was particularly optimistic for the future of Disney’s Experiences segment, saying it can be “an even bigger and more successful cash-flow generation business.

“Parks and Experiences overall remains a growth story, and we are managing our portfolio exceptionally well.

“Over the last five years, return on invested capital has nearly doubled in our domestic parks, and we have seen sizeable increases over that same timeframe across the total Experiences portfolio as well. Not to mention, the improved guest experience ratings we’re now seeing at every one of our parks.”

Capex to turbocharge growth

Capital expenditure for the whole company is set to rise from $6 billion in fiscal 2024 compared to the prior year, driven by higher spend at Experiences, including investment ahead of the launch of three new cruise ships in 2025 and 2026.

Disney announced plans in September to spend $60 billion on its parks, experiences and products division over the next 10 years to turbocharge growth.

Iger said, “As we announced in September, we plan to turbocharge growth in our Experiences business through strategic investments over the next decade. Given our wealth of IP, innovative technology, buildable land, unmatched creativity, and strong returns on invested capital, we’re confident about the potential from our new investments.”