Habo, a consulting firm that provides strategic planning and market/consumer intelligence,has shared findings from a recent study that highlighted the appeal of Las Vegas and Orlando to domestic visitors.

According to the consultancy's research into US entertainment consumers (defined as those aged 18 and over who engaged in at least one paid out-of-home entertainment activity in the last year), 33% plan to visit Las Vegas, and 23% Orlando, within the next two years.

Additionally, theannualnumber of Americans visiting Orlando is nearly double that of Las Vegas,predominantlybecausemany travel parties visit Orlando with children.

Strategic approach

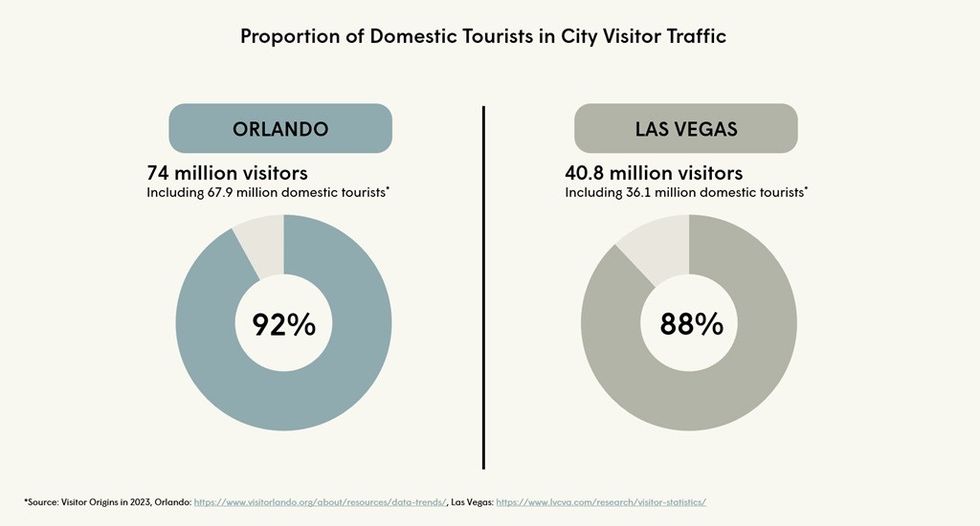

Both of these cities are recognised for their appeal to international visitors, driven by Las Vegas' strong gambling and nightlife offering and Orlando's wide variety of theme and attraction parks.

They also both number among the most popular destinations among Americans, with the vast majority oftheir visitors being domestic tourists. As such, understanding the characteristics of American visitors is crucial for effectively positioning offerings in these markets.

"To succeed in major hubs like Orlando and Las Vegas, entertainment providers must understand their target audiences and the key dynamics that shape domestic tourists’ demand," says the firm.

"While both markets offer significant opportunities, providers should tailor their strategic approach to visitors’ preferences and behaviors."

The consultancy identifies three keydomestic tourismtrends as:

Proximity

"Beyond their entertainment offerings, proximity also plays a key role in the appeal of Orlando and Las Vegas for domestic tourists," says a spokesperson from the consultancy.

Consistent with findings from prior research, Habo found that entertainment attractions in Orlando and Las Vegas are the primary drivers of visits among domestic visitors, and have defined the reputation and appeal of both locations.Yet, when American travellers select a destination for a domestic trip, proximity is also a key consideration.

As a result, Las Vegas tends to attract more visitors from the Western US, at 59%, with California as the primary state of origin for 36% of visitors. In comparison, Orlando welcomes more visitors from the Southern region, with the majority of domestic tourists travelling from Florida (41%), in addition to Georgia, Texas,andother northeastern states, including New York.

This presents a strategic opportunity to target audiences based on geographic location, and maximise marketing activity for entertainment providers looking to enter these markets.

Targeted offerings

As Orlando and Las Vegas appeal to distinctive audiences, entertainment providers can benefit from aligning their offerings to the preferences and behaviours of the target segments in these destinations.

As with international visitors, the entertainment focus at these destinations also informs the demographics of domestic visitors. For example, Las Vegas’s positioning around gambling and nightlife influences the composition of its audience, and 57% of visitors are men. Travellers also tend to visit either as couples (51%) or in groups of friends (34%).

In contrast, Orlando attracts a more diverse demographic, with a broader range of ages and group compositions. The destination particularly appeals to families, both with children (38%) or other family members (35%).

"As the entertainment landscape has evolved to better serve these key audiences, Orlando has expanded its offerings to include mass audience attractions like zoos and aquariums, while Las Vegas has developed complementary offerings such as live performances and immersive experiences.

"With this in mind, entertainment providers should ensure a strong product-market fit with destinations’ positioning, offering experiences that attract key audiences to these cities in order to sustain long-term demand," says the firm.

Early engagement

As Orlando and Las Vegas are both highly competitive entertainment markets, entertainment providers can benefit from engaging with visitors early in their customer journey.

Engaging with consumers at the appropriate point in their decision-making process is essential for efficiently targeting key audiences, in addition to sociodemographic and geographic variables.

According to Habo's research, domestic travellers frequently schedule certain activities ahead of time when travelling to entertainment-focused locations like Orlando and Las Vegas.

For example, the majority of American tourists buy tickets for at least a few activities in advance of a trip to Las Vegas. Those who don't will at least list some activities that they would like to experience.

Because of this dynamic, the search process is crucial to their decision-making, and entertainment providers should position their experiences to ensure they are top-of-mind for travellers.

"This pattern also shows the importance of engaging with audiences early—before their trip even begins—to capture a share of their spending," says the consultancy, "with the best strategies and most sought-after sources for domestic tourists being search engine optimization, social media, tourism and destination websites, as well as user reviews."

To navigate entertainment-driven markets like Orlando and Las Vegas, Habo recommends:

- Tailoring targeting strategy to audiences’ geographic location and sociodemographic characteristics.

- Ensuring strong product-market fit with both the target audience and the destination positioning.

- Strategically positioning the experience early in visitors’ trip planning, search and decision-making process.

Earlier this year, Habo discussed how it is helping sports, entertainment, tourism, and experiential organisations to align their creative vision with business strategy with its data-backed insights and proprietary methodologies. These methodologies are centred on the Habo Index, a structured approach that enables organisations to understand the potential of their offerings, adapt their business models, and plan for continued growth.

Guinness Storehouse

Guinness Storehouse  Image credit Stephen Sweeney,

Image credit Stephen Sweeney,  © LEGOLAND California Resort

© LEGOLAND California Resort Image credit Twycross Zoo

Image credit Twycross Zoo

Image credit R Thenadey

Image credit R Thenadey Image credit R Thenadey

Image credit R Thenadey