Operating as Setpoint LLC, a JR Automation and Hitachi Group company, the team’s engineering DNA originates in precision manufacturing. Its early work included automated systems for airbags, electric-vehicle batteries, and defence applications.

Today, that expertise in high-speed, high-reliability automation underpins some of the most advanced ride systems ever built, where safety margins and split-second synchronisation are critical.

Derek Morris and Steve Boney

Derek Morris and Steve Boney

Derek Morris, manager of the project management office, and Steve Boney, business development executive, spoke with blooloop about JR Automation’s history, what sets the team apart, and how the company continues pushing the boundaries of ride engineering and automation.

Working on epic projects

Setpoint’s founders—former Arrow Dynamics engineers—brought their passion for ride design into the automation world in the early 1990s. Once their non-compete expired, they re-entered the themed entertainment industry, delivering The Swing Thing for Carowinds and Hersheypark.

At the same time, the company continued developing bespoke automation solutions, a discipline that would ultimately shape its future in attractions by building its reputation for speed, precision, and reliability.

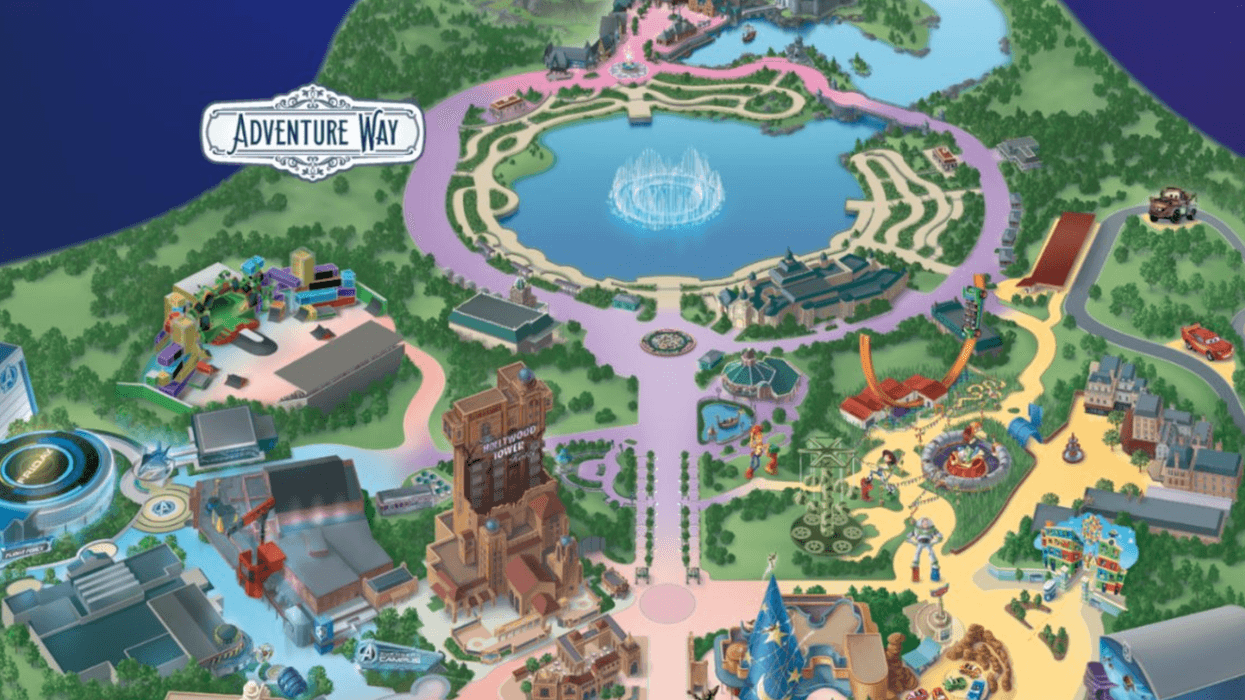

A pivotal moment came in the mid-2000s, when a major operator enlisted Setpoint to develop a groundbreaking attraction based on a popular franchise.

With just four employees in its amusement division at the time, the team expanded rapidly to meet demand.

This momentum accelerated further after the 2011 merger of a local Utah automation company with Setpoint, strengthening the company’s capabilities and enabling participation in high-profile automation programmes, as well as major amusement projects in the US, Japan, Beijing, and Singapore.

This merger also smoothed the way for the later JR Automation acquisition.

From there, the team became known for tackling the “never-been-done-before,” often becoming the partner operators call when creative ambition demands seemingly impossible engineering.

In 2015, that same operator returned—this time with a request for one of the most technically innovative coaster systems ever attempted.

Automation for first-of-their-kind rides

For this attraction, JR Automation helped design a multilayered track configuration that allowed vehicles to appear to “jump” from one track to another safely.

Achieving the illusion required millimetre-precise synchronisation between vehicle motion and themed scenery, a dual-track safety architecture, and careful modelling of vibration and impact—all while preserving high throughput.

The result was a system that delivered the desired thrill with industrial-grade reliability, day after day.

In another large-scale attraction, multiple vehicles needed to move through a tightly choreographed story with sub-second precision. JR Automation engineered high-capacity rotating platforms capable of near-zero-tolerance alignment between vehicles and staged scenes.

By integrating redundant positioning systems and advanced control algorithms, these platforms moved seamlessly and invisibly to guests, ensuring uninterrupted storytelling and dependable operations.

Examples like these reinforce JR Automation’s reputation for solving first-of-their-kind challenges. Morris says the company’s structure and culture, combined with its roots in industrial automation, enable a speed few can match:

“A lot of our work for leading operators involves solving technical problems that haven’t been done before. One reason clients choose us is our speed. We have a tight-knit team and a well-defined process that lets us move quickly through design iterations.”

He adds that automation expertise is a significant advantage:

“That background helps us approach problems creatively and efficiently, often in ways that fall outside the norms of the amusement industry.”

Helping the industry keep up with guest expectations

In an industry defined by continuous innovation, driven by escalating guest expectations and competition among top operators, the team has seen major shifts in both technology and creative ambition.

“Our customers love to push boundaries,” says Morris. Boney adds: “One raises the bar, then the others respond. All are constantly evolving.”

This dynamic has produced large, technically demanding projects that challenge the limits of what’s possible at scale.

One key trend is interactivity, with environments responding dynamically to guest movement. JR Automation developed a tessellated motion-tile system for fully responsive floors. Each tile moves independently, creating terrains that flow, pulse, or shift underfoot.

Achieving this required compact, robust actuators; a distributed control network for real-time responsiveness; and impact-resistant materials. The result is an environment that feels alive and embeds guests directly into the story.

Technical trends over the past decade also point toward increasing complexity and customisation, including new ride-vehicle types, heavy-duty motion bases, and tailored coaster profiles.

For example, dark rides require tight synchronisation between vehicles and show elements. JR Automation engineered rotating scenic structures that automatically reset for the next group within seconds, maintaining strict safety separations and consistent performance.

By treating attractions as integrated systems, rather than separate ride and show components, the team helps ensure smooth, immersive guest experiences.

High-fidelity simulator platforms add another layer of complexity. JR Automation designed hidden actuation systems for large-format simulators, enabling smooth micro-movements synced precisely with media playback.

High-bandwidth actuators, closed-loop control, and structural optimisation minimised noise and visible motion, allowing the technology to fade from the guest’s awareness.

Reliability is key

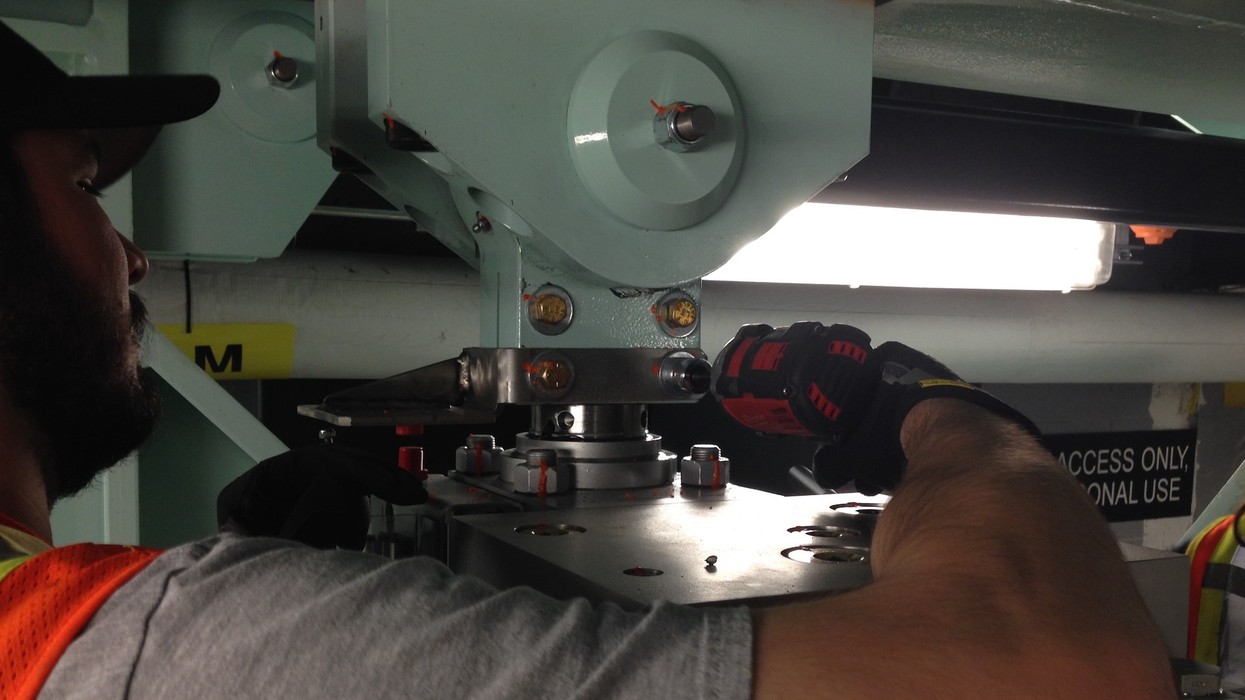

Behind the thrills, ride systems must deliver exceptional reliability; major attractions simply cannot afford downtime.

JR Automation applies industrial automation principles to gates, doors, and scenic elements that may cycle hundreds of thousands of times per year. Custom cycle-testing, rapid prototyping, and rigorous reliability engineering ensure long-term performance without compromising aesthetics or safety.

Morris says: “Automation systems are often more complex than amusement rides—they involve many small, fast-moving parts—so that experience with precision and uptime translates directly to the ride world.”

High throughput, personalisation, and dynamic experiences add further challenges. Parks now require attractions that deliver individualised experiences while maintaining operational efficiency.

JR Automation addresses this through adaptive control systems, predictive maintenance strategies, and modular ride components, ensuring responsive, immersive experiences without sacrificing reliability.

Meanwhile, show action elements are evolving rapidly to support deeper levels of immersion. Creatives are pursuing richer projection mapping and more intense environmental effects, which require enhanced mechanical and show-action systems. Even “non-ride” elements are now critical to storytelling.

Show doors, water curtains, and magical reveals are increasingly central to the narrative, demanding precise engineering to integrate seamlessly.

JR Automation’s flexible team

A major strength of JR Automation is its ability to scale to projects of any size, supporting everything from major E-ticket attractions to small ride-vehicle modifications.

“We can tackle everything from a $20,000 proof-of-principle to a $40-million ride system,” says Morris.

“Offering both small and large projects lets us help clients early, sometimes with small time-and-material contracts, to solve tough engineering problems before a major project even begins.”

That early involvement often proves essential.

“It’s beneficial for them and for us: they get early solutions, and we get valuable insight from day one.

“We essentially become an extension of their engineering team. And we stay involved long-term through maintenance, retrofits, and rebuilds. That ongoing partnership keeps rides running smoothly and keeps us connected to park operations.”

Trust is another major factor, says Boney:

“Big operators don’t like to work with people they don’t know. You earn trust by taking small projects, proving you can deliver, and standing by them when things get tough. Once you’ve done that, you become one of the few suppliers they call when they want something groundbreaking.”

The work culture behind the scenes

At the core of the company’s speed is a deeply collaborative environment.

“We have a tight-knit culture,” Boney says. “Engineers, builders, and fabricators work closely. Mechanical and electrical engineers often jump in to help each other. Program managers have experience across multiple fields.”

The company’s project-delivery process is directly influenced by its roots in automation. Most automation projects are short-cycle, often under a year, sometimes as short as six months, so processes are optimised for rapid milestone delivery.

The team includes engineers, builders and electricians. Crucially, the structure is designed to avoid bureaucracy:

“Each project team is empowered to make its own decisions,” says Morris. “It’s not bureaucratic. Decisions happen fast, every day, within the team. That’s what keeps us agile.”

Collaborating with creativity

Bringing creative visions to life requires constant collaboration between creative and engineering teams.

“That’s one of our biggest challenges,” says Morris. “There’s constant back-and-forth with creative teams— ‘we can do this, but not that.’ Physics, safety, and guest comfort set real limits, especially around forces and restraints.”

He emphasises the importance of imagination: “Creative people dream big, and we need that. But we also need to ensure ideas are physically possible and safe. It’s a collaborative process of meeting in the middle.”

Let creative teams dream freely at first. Don’t bring engineering in too early, or it can stifle imagination.

The team offers guidance for operators developing new attractions, particularly around timing:

Morris advises: “Let creative teams dream freely at first. Don’t bring engineering in too early, or it can stifle imagination. But once there’s a clear concept of the feeling or environment they want, it’s critical to involve engineers early to validate feasibility.

“Quick iteration between creative and engineering teams is key.”

Physical prototyping also plays a crucial role: “Large-scale mockups help enormously. Building something physical, even full-scale, lets both sides see what’s possible and refine the design together.”

Custom automation supports theme park trends of the future

Looking ahead, the team sees even deeper immersion and personalisation on the horizon.

“Interactivity has always been big,” says Boney. “Guests want experiences that feel personal and fully envelop them in the story. That demand keeps growing. And the immersiveness of the ride continues to improve. You feel like you’re there.

"Both of those things will continue to advance.”

Morris agrees:

“If you look at rides from 10-15 years ago, they felt incredibly immersive at the time, but compared to today’s rides, they are modest. The bar keeps rising, and we’re nowhere near the limit of what’s possible.”

From its beginnings in industrial automation to its role in some of the world’s most sophisticated ride systems, JR Automation’s Setpoint Division has built a unique bridge between manufacturing precision and creative storytelling.

Its combination of technical excellence, creative collaboration, and long-earned trust with industry leaders has made the firm a vital behind-the-scenes contributor to modern themed entertainment.

And as immersive technologies and interactivity continue evolving, JR Automation will keep engineering the impossible.

Derek Morris and Steve Boney

Derek Morris and Steve Boney

The Incredible Hulk Coaster, Universal Orlando

The Incredible Hulk Coaster, Universal Orlando

Twilight Zone: Tower of Terror Image credit Simon de Bruijn

Twilight Zone: Tower of Terror Image credit Simon de Bruijn  Fury 325 at Carowinds

Fury 325 at Carowinds  The Revenge of the Enigma drop tower at Parque Warner Madrid by S&S

The Revenge of the Enigma drop tower at Parque Warner Madrid by S&S