Saudi's entertainment sector is rapidly growing. In January 2023, Mohammed bin Salman, the crown prince of Saudi Arabia, confirmed Diriyah as the PIF's fifth giga-project. Located on the edge of Riyadh, it joins the country's existing giga-projects: Neom, Red Sea, Qiddiya and Roshn.

The kingdom has plenty of smaller – but still major – projects in development, too. Saudi Entertainment Ventures, now a Qiddiya subsidiary, is investing $13 billion in the development of 21 entertainment destinations.

Additional projects include AlUla, the world’s largest living museum, and Amaala, a luxury development with a focus on wellness.

Saudi Arabia plans to reach 150 million visits annually by 2030. Since opening to tourism in 2019, it has become one of the fastest-growing markets globally.

And, since the launch of Vision 2030 in 2016, the kingdom has awarded contracts with a total value of $196bn, Knight Frank's 2025 Saudi Arabia Giga Projects report found.

Qiddiya

Qiddiya, a multibillion-dollar entertainment destination in Riyadh, is set to be the world’s largest entertainment city. It will even surpass Walt Disney World in Florida. Qiddiya Investment Company (QIC) created the giga-project’s masterplan with Bjarke Ingels Group.

Qiddiya City, the Qiddiya giga-project's destination for entertainment, sports and cultural experiences, will include the Aquarabia water park, the world’s first Dragon Ball theme park, a gaming and esports district, and an immersive motorsport circuit.

Highlights include a stadium with state-of-the-art holographic technology, and a performing arts centre where the theatre experience is enhanced through VR, AR and AI.

Aquarabia water park

When it launches, Aquarabia will be the largest water park in the Middle East at 25 hectares, offering 22 rides and experiences by WhiteWater, a leading waterpark manufacturer.

These include the world's tallest water coaster, largest drop body slide, tallest waterslide and longest mat racer. Highlights in Aquarabia also include the kingdom's first surf pool, and an extreme watersports zone.

Additionally, Aquarabia will include the world’s first underwater theme park ride, Aquaticar: Legend of the Glowing Guardian. This is by Sub Sea Systems, Inc. (SSS), a company specialising in immersive, memorable and hands-on aquatic encounters that educate through entertainment.

Falcon’s Creative Group, part of Falcon’s Beyond Global, has been involved in the design and master planning of Aquarabia.

Six Flags Qiddiya City

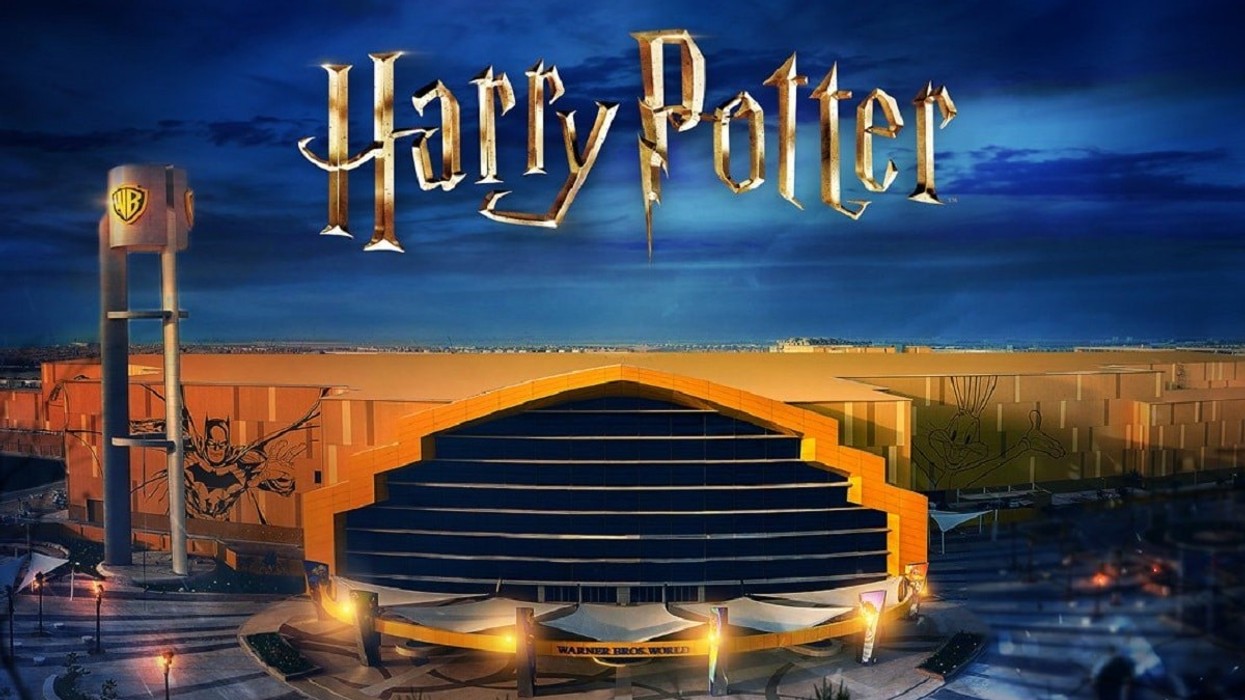

Six Flags Qiddiya City, the first Six Flags theme park outside of North America, opened in Saudi Arabia on 31 December 2025. The new park is home to 28 rides and attractions, including the world's longest, fastest and tallest roller coaster.

Located just 40 minutes from Riyadh, Six Flags Qiddiya City combines immersive entertainment with innovative technology across its six themed lands.

Highlights include Falcons Flight; the world's tallest, fastest and longest coaster, as well as Iron Rattler; the world's tallest tilt coaster, and Spitfire; the world's tallest inverting coaster.

Intamin, a creator of record-breaking amusement rides, partnered with Qiddiya to design Falcons Flight.

Into The Deep, an interactive dark ride at Six Flags Qiddiya City, was installed by Triotech, an award-winning creator of media-based attractions.

"Six Flags is proud to announce the opening of Six Flags Qiddiya City in Riyadh, Saudia Arabia, a landmark project that will redefine entertainment in the region," said John Reilly, president and CEO of Six Flags Entertainment Corporation.

"This world-class destination combines cutting-edge, record-breaking attractions, immersive experiences for all ages, and the signature thrills that have made Six Flags a global leader.

"We look forward to welcoming guests from across the kingdom and beyond to experience the future of fun at Qiddiya City."

Adult tickets to Six Flags Qiddiya City start from $85, while children's tickets start from $70.

Dragon Ball theme park

Qiddiya City will also be home to the world’s first Dragon Ball theme park, a 500,000-square-metre destination with seven areas themed to iconic locations from the original series.

The park will feature more than 30 attractions, including five state-of-the-art rides. Also, a 70-metre-high figure of Shenron (the magical dragon from the Dragon Ball series) containing a large-scale roller coaster is planned for the site.

Neom

Another Saudi Arabian giga-project, Neom, was announced in 2017. This $500bn ‘land of the future’ will be 33 times the size of New York City, and nearly the size of Belgium.

It will house cognitive cities, ports, research centres, entertainment venues and tourist destinations. Saudi officials have described Neom as “the world’s most ambitious project”. They expect to welcome around one million visitors by 2025 and five million by 2030.

“If we are to solve the challenges of tomorrow, we must face up to them today, no matter how difficult they may seem,” said Neom’s former CEO Nadhmi Al-Nasr.

The project, he said, is “addressing some of the most pressing challenges facing humanity by bringing together a community of the brightest minds committed to reimagining what a sustainable future will look like in 20 to 30 years, and building it today.”

Neom’s first luxury island, Sindalah, launched in late 2024. Designed by yachting architecture firm Luca Dini, Sindalah features world-class restaurants, hotels, venues and experiences, as well as a state-of-the-art marina and yacht club.

Entertainment offerings on the island include 38 F&B venues and 36 luxury retail outlets, a beach club providing music experiences at night, and a beachfront golf club.

$500bn ‘land of the future’

Preserving Sindalah's natural marine habitat was key to the island's development. Its surrounding waters are home to 1,100 species of fish and more than 300 coral species.

Other projects at Neom include The Line, a zero-carbon city with “vertically layered” buildings for work, living and leisure. Trojena is a mountain resort with a ski village, a ski slope, wellness resorts and a nature reserve, and Oxagon is an octagonal floating port city.

Additional destinations at Neom are Treyam, Leyja, Epicon, Siranna, Utamo, Norlana, Zardun and Aquellum. Utamo, an immersive destination for art and entertainment, is described as “a theatre of the future where reality and the digital realm converge”.

As above, The Line will vertically layer homes, offices, parks, pedestrian areas and schools within two mirrored facades. These will stretch more than 105 miles and rise 500 metres above sea level. Residents will have access to all facilities within a five-minute walk. The city will be just 200 metres wide and will run on 100 percent renewable energy.

In May 2024, Saudi Arabia’s economy minister said Neom’s projects will go ahead as planned following reports that plans for The Line had been scaled back. “All projects are moving full steam ahead,” Faisal Al Ibrahim told CNBC at the World Economic Forum’s special meeting in Riyadh.

“We set out to do something unprecedented and we’re doing something unprecedented – and we will deliver something that’s unprecedented.” He said that “for Neom, the projects, the intended scale is continuing as planned".

In 2025, Neom announced Hidden Marina as the first phase of The Line. This will house more than 80,000 residential units, 9,000 hotel rooms, commercial and retail spaces, schools, police and fire services, and "all the necessary infrastructure to support a self-sustaining city", said Denis Hickey, chief development officer of Neom, the Saudi Gazette reported.

"World’s most ambitious project"

"Neom is not just a city but an urban revolution designed to push boundaries, redefine economies, and establish a new standard for future urban development," said Hickey.

"With construction on track, Neom's vision of a fully integrated, futuristic metropolis is rapidly becoming a reality."

The Red Sea

Regenerative tourism developer Red Sea Global is behind The Red Sea, another giga-project in Saudi Arabia with a focus on luxury, sustainability and innovation. Formerly known as the Red Sea Project, The Red Sea welcomed its first guests in 2023 and now has nine hotels open.

It is billed as the world’s most sustainable luxury tourism destination. “Our destination is one of extraordinary natural beauty, which we have a responsibility to protect and enhance for future generations,” said John Pagano, group CEO of Red Sea Global.

Red Sea Global, owned by the PIF, aims to build 50 resorts along the Red Sea coast by 2030, each committed to regenerative tourism. The company is also leading the creation of the neighbouring Amaala development.

Pagano said the group is producing “mega-scale responsible developments that positively shape the futures of both the people who we welcome and employ, and the places in which we operate”.

Regenerative tourism destination

“We are not only expanding our footprint to help create massive economic opportunities – valued at hundreds of billions worth of riyals – for the people of Saudi Arabia,” he added. “We also want to set new global standards in development and inspire the industry to do better.”

With plans to become the world’s most responsible developer, Red Sea Global is exploring and implementing ideas like green concrete to limit emissions, clean mobility strategies, and sustainable food production. The destination will, of course, be powered by 100 percent renewable energy.

Red Sea Global has also partnered with biotechnology firm Blue Planet Ecosystems (BPE) to produce seafood sustainably on-site, and a state-of-the-art robot is already cleaning the beaches at The Red Sea.

The Red Sea will be the world’s first destination to provide bottled water made from air and sunlight, produced using patented solar technology. The glass bottles will be reusable and refilled on site. Pagano said the goal with this project is to “deliver luxury experiences in ways that protect, preserve and enhance the natural environment”.

As for technology, intelligent resort management processes will be used to track visitor flow, prevent airport delays and minimise overcrowding. An extensive smart destination platform will monitor, simulate and predict the environmental impact of operations.

State-of-the-art technology across the destination will provide personalised visitor experiences, frictionless customer experiences and seamless exploration.

Additionally, the world’s first zero-carbon 5G network will be at The Red Sea’s Six Senses Southern Dunes resort. It will provide the highest speeds for 5G connectivity in the region and will be powered by 100 percent renewable energy via more than 760,000 solar panels built by Red Sea Global.

The Red Sea is being developed over 28,000 square kilometres of land on Saudi’s west coast. It is surrounded by coral reefs, desert canyons, dormant volcanoes and archaeological sites.

Upon completion in 2030, the destination will have 50 resorts with up to 8,000 hotel rooms and more than 1,000 residential properties across 22 islands and six inland sites. It will also include luxury marinas, golf courses, entertainment and leisure experiences, and F&B facilities.

The new Red Sea International Airport is already operational, with the inaugural flight touching down on the new runway in September 2023. “Saudi Arabia’s position on the global tourism map is all but secured,” said Pagano.

Coral Bloom and Desert Rock

Desert Rock, an eco-friendly mountain retreat at The Red Sea, is designed by Oppenheim Architecture to protect and preserve the environment.

“We wanted to create a destination that allows guests to experience Saudi Arabia’s untouched beauty,” said Pagano. “Desert Rock will provide guests with uninterrupted spectacular views while preserving the natural landscape for future generations to enjoy.”

In September 2025, Red Sea Global opened the first resorts at Shura Island, the main hub island at The Red Sea. Previously referred to as Coral Bloom and created by Foster + Partners, it includes 11 world-class resorts, as well as luxury amenities, high-end F&B outlets, retail experiences, and cultural programming.

“The materials we use and the low impact they have ensures that the pristine environment is protected. Furthermore, the additions we make to the island serve to enhance what is already there – hence the name, Coral Bloom,” said Gerard Evenden, head of studio at Foster + Partners.

Thuwal, a new private island retreat, was announced by Red Sea Global in October 2023. It is separate to The Red Sea and Amaala, with no third-party hospitality or hotel operators involved.

Red Sea Global has also launched a new adventure and entertainment district called Adrena, a short drive from Shura Island.

Roshn

Unlike Saudi Arabia's other giga-projects, Roshn is delivering new urban communities across the kingdom. Backed by the PIF, the real estate developer is creating its communities in cities such as Riyadh, Jeddah, Al Kharj, Al Hofuf, Al Qatif, Makkah, and Abha.

These feature pedestrian-friendly ‘living streets’, green spaces, and retail and entertainment outlets, as well as hospitals, medical centres, mosques, and sports facilities.

Diriyah

As above, Diriyah has been confirmed as the PIF's fifth giga-project in Saudi Arabia. Located on the edge of Riyadh, the $62.2bn development is a culture and lifestyle destination providing entertainment, dining and shopping. It also includes At-Turaif, a historical district and UNESCO World Heritage Site.

Diriyah's education and arts districts, called the Qurain Cultural District and the Northern District, include several cultural assets.

The former will feature a cinema, museums, and academies for writing, Najdi architecture and mud building, Arab music, and performing arts. The latter will include the King Salman Foundation, as well as museums, a university, a library, and a public square.

"Qurain Cultural District and Northern District are two of our most important and significant areas of the Diriyah masterplan and demonstrate the range and diversity of what our 'City of Earth' has to offer," said Jerry Inzerillo, group CEO of Diriyah Company.

The first hotel at Diriyah, Bab Samhan, debuted in January 2025. Eventually, Diriyah will feature around 40 hotels, and recently broke ground on seven luxury properties.

Diriyah Square will serve as the project’s commercial heart. This will offer culture, retail, leisure and entertainment, as well as luxury hotels, and places to work and live.

"Diriyah Square has crafted a collection of the finest culture, hospitality, retail, leisure and entertainment assets,” said Inzerillo. "The project is set to become one of the world’s greatest gathering places, all in the vibrant heart of authentic Diriyah.”

Education, arts and culture

Part of Diriyah Square will be a new Time Out Market, scheduled to open in 2027. It will have 23 kitchens, five drinks outlets, multiple stages, event and exhibition spaces, a demonstration kitchen, kitchen academy and kitchen lab.

"The team at Time Out Market share our vision – creating a vibrant dining experience for both locals and visitors alike that complements the retail, lifestyle and culture ingrained across Diriyah, and especially here at Diriyah Square," Inzerillo said.

Amaala

The PIF announced its plans for Amaala, Red Sea Global’s bespoke, regenerative, wellness destination, in 2018. Although Amaala is not a giga-project, it's one of the flagship Vision 2030 developments.

"It remains central to the kingdom’s ambition to become a global tourism leader," said Pagano. He described Amaala as "one of the top global tourism destinations of the future".

Amaala is billed as an ultra-luxury destination focusing on wellness and healthy living. A beacon of Amaala will be its arts village for Saudi and international art, and for events, concerts and shows put on in dramatic natural surroundings.

Regenerative wellness destination

Once complete, Amaala will feature nearly 4,000 rooms across 30 hotels, in addition to 1,200 luxury villas, apartments and homes. There will be retail, dining and wellness facilities, and Amaala will be powered entirely by solar energy. This will result in a saving in CO2 emissions equivalent to nearly half a million tonnes annually.

The destination will also limit the number of annual guests to 500,000 to protect the local environment, and plans to deliver a 30 percent net conservation benefit to local ecosystems by 2040.

“We use the top technologies within our resorts, like making sure that the cooling systems are down, that there's no noise, and ensuring that we don't have blackouts," Melisa Pezuk, head of development at Amaala, told blooloop.

"We want to make sure that we protect the environment, and there is a dark sky policy across all of our developments. We also have very sensitive beaches, which are turtle nesting beaches, and the whole development is solar powered.”

Technology-driven treatments and innovative practices will be showcased in Amaala’s wellness resorts, as guests increasingly seek new ways to relax and prioritise their health and wellbeing.

One resort is in partnership with longevity clinic and wellness brand Clinique La Prairie. This will have a diagnostics lab, a museum, a beach club, a workshop and training rooms, a private dining space and a cooking school.

Medical services provided by Clinique La Prairie will include radiology, physiotherapy, aesthetics, neuroscience and dentistry. Wellbeing services will include a cryochamber, hyperbaric suites and IV infusion.

"Wellness tourism around the world is growing tremendously. It's an exponential growth at the moment. There are more informed travelers today. They want to go to the places that are giving them the best, healthiest options," Pezuk said.

Building work is well underway on Triple Bay, Amaala's first phase. This will include 13 resorts with more than 2,000 hotel rooms. Nearing completion are the marina and yacht club.

An immersive marine experience

Also located in the Triple Bay marina will be a marine life centre created by architectural firm Foster + Partners. The state-of-the-art Corallium Marine Life Institute will serve as a scientific research centre and visitor destination. Designed to resemble the Red Sea’s coral formations, it will cover an area of more than 10,000 square metres.

The marine institute will house one of the world’s largest artificial reefs, futuristic laboratory spaces, educational exhibitions, and augmented reality (AR) experiences. Visitors will also get to walk underwater, snorkel with rare species, take part in lab tours, and dive in a submarine.

AlUla

AlUla, billed as the world’s largest living museum, is another major attraction for Saudi Arabia, although also not a giga-project.

The Royal Commission for AlUla (RCU) is investing $5.2bn in the first phase of AlUla. This is set to complete in 2023. The $15bn AlUla project will be created in three phases, in 2023, 2030 and 2035. RCU is working alongside the French government agency Afalula on the development.

"There is an extraordinary volume of work ongoing in AlUla by both local and international archaeological teams. However, we are only just beginning to understand the complexity of AlUla’s past," said Rebecca Foote, director of archaeology and cultural heritage research at RCU.

"AlUla is a true hidden gem in the Arabian Peninsula, and we are slowly revealing its secrets."

World’s largest living museum

AlUla is located close to Saudi’s first UNESCO World Heritage Site, Hegra. This was opened to the public for the first time in 2020. Upon completion in 2035, AlUla will include five unique districts, five heritage sites, 15 cultural venues and museums, 10 million square metres of green space, and 5,000 hotel rooms.

The plans also include a luxury resort designed by French architect Jean Nouvel, located in the mountains of AlUla, within the Sharaan Nature Reserve.

As for museums, the AlUla Contemporary Art Museum is designed by architect Lina Ghotmeh and will be a space for exhibitions, commissions, residencies, research and publications. Another institution planned for AlUla is a museum of the incense trade route.

Hamad Alhomiedan, director of arts and creative industries at the Royal Commission for AlUla, said: "The AlUla Contemporary Art Museum marks another vital chapter in AlUla's journey, connecting our deep local heritage with the innovations shaping the global art landscape."

The project is predicted to increase the population of AlUla to 130,000 residents. It will also create 38,000 jobs, and is estimated to contribute $32bn to Saudi’s GDP.