Activitist hedge fund ValueAct has acquired a 5.4% stake in Merlin Entertainments, making it the third largest shareholder in the company.

The stake was disclosed on the London stock market on Monday morning, resulting in a 2% rise in Merlin Entertainments share prices to 350p.

ValueAct has a history of pushing for management change at companies it invests in, including Roll-Royce. It has also advocated for mergers at companies such as Valeant Pharmaceuticals and Willis Towers Watson.

Merlin’s main shareholder remains family investment company and owner of the Lego brand Kirkbi, with a 29.8% stake. The charity Wellcome Trust holds a similar-size stake to ValueAct.

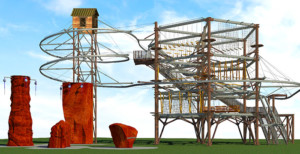

Last October, rumours surfaced that Merlin was exploring a purchase of US theme park chain SeaWorld. Earlier this month, Merlin announced it would be open a Little Big City attraction and one of its history-themed Dungeons in China as well as a third Legoland Discovery Center.

https://www.ft.com/content/4f7f3d50-1568-11e8-9376-4a6390addb44