What makes a no-name, unsponsored, non-professional surfer who doesn’t work in the wave pool industry qualified to share the top surf parks?

To date, I have traveled across the United States and around the globe to experience 27 different wave pools. My first-hand experience as a regular paying customer allows me to remain unbiased and offer undiluted opinions on what each unique surf park has to offer.

Waco Surf

Waco Surf

My surf park resume spans across 26 cities throughout 10 countries, featuring 15 different wave-making technologies. The tech ranges from traditional traveling waves to stationary deep-water waves. I’ve clocked more than 145 hours across 134 sessions.

No two surf parks are alike for a multitude of reasons. While the wave itself is the main ingredient to these surfing attractions, other factors create the larger customer experience that guests are paying for.

The top surf parks

Factors in choosing the world's best surf parks include:

- Booking experience

- Food & beverage offerings

- Ancillary activities onsite

- On-property surf shop

- Clean, convenient restrooms/showers/changing rooms

- Locker availability

- Rental equipment

- Overnight accommodations

- Hot tubs and recovery pools

- Viewing areas

Beyond these features, guests remember the surf session cost, tasteful marketing and communications, off-season deals and promotions, photo and video offerings, session safety and instruction briefings, venue accessibility, friendly staff and quality customer care before, during and after their surfing experience.

With all these aspects in mind that make for a great customer experience, let’s start with my top surf park and work down the list of nine:

1) Lost Shore Surf Resort, UK

Nestled in a former quarry sits Scotland's first surf park and Europe’s largest wave pool. Lost Shore Surf Resort opened in late 2024, featuring a 52-module Wavegarden Cove system that offers fun waves on both the left and right side of this state-of-the-art machine.

Guests can choose from a range of surf session levels, including: Cruiser, Turns, Manoeuvers, Barrels and High Performance. Lessons are also offered for those who have never surfed before.

Sessions last 60 minutes and offer a healthy number of waves to catch and ride. For those not ready to invest in their own surfboard or wetsuit, or who don’t want to travel with this bulky equipment, both can be rented on-site.

Surfing aside, this surf park offers a handful of reasons to make your visit an overnight stay. Of the 27 wave pools I visited, only four offered on-site accommodation. Lost Shore stands out, offering 50+ units surrounding the picturesque wave pool, ranging from hilltop lodges to waterfront pods.

Goldys trying the barrel waves at Lost Shore Surf Resort in ScotlandPhotographer: Samuel Howard

Goldys trying the barrel waves at Lost Shore Surf Resort in ScotlandPhotographer: Samuel Howard

Don’t be fooled by the size of the poolside pods; they are equipped with a king-size bed, controlled AC/heat, heated floor, bathroom, shower, fridge, and even mood lighting. Waking up to the sounds of Wavegarden swells and watching the sun set over the pool is an experience in itself.

Equally important as accommodation is the on-site food and beverage (F&B). This surf park goes above and beyond with a “Food Hub,” which is home to three dining options – Lost Kitchen, Lost Taco and a local pizza favorite, Civerinos.

Offering different options on-site allows guests to mix it up and grab a bite between surf sessions.

With surf, accommodation and F&B covered, Lost Shore also keeps you busy with surfskate lessons offered by the SurfSkate Academy, wellness treatments at Spa Studio, poolside wood-fired sauna sessions at Spear Sauna or a scenic walk along the breathtaking walking path around the surf park perimeter.

The venue goes above and beyond the core surf park offerings through its Surf Therapy collaborations with The Wave Project and Inclusive Surfing Scotland. Weekly events fill the calendar like Quiz Night, dance events, movie premieres, kids surf camps and specialty surf competitions.

Surf park stats: Lost Shore Surf Resort welcomed 200,000 visitors in 2025, 70,000 of whom were surfers and 10,000 accommodation guests. Those visitors traveled from 67+ countries to experience this surf park.

Real customer perspective: Lost Shore was a top experience among surf parks I’ve visited. Every part of the guest experience is accounted for, including fun waves to surf, places to stay overnight, a food hub offering many options and fun ancillary activities. I felt like a valued customer and that I got my money’s worth.

2) The Wave, UK

The Wave opened in 2019 with a foundational respect for people, planet and profit. These values have been apparent since the 40-module Wavegarden Cove pushed out the first waves for surfers seven years ago.

To list only a few examples, The Wave is an accredited B-Corporation, has installed a solar field to produce renewable energy for the wave pool and reinvests profit into the surf park experience.

The Wave was one of the first two second-generation Wavegarden technologies to open publicly and the first commercial Cove in Europe. Surf sessions range from beginner to expert, with many levels in between for guests to progress, boasting waves ranging from 50cm (1.7ft) to almost 2m (6.5ft) in height.

While there are no poolside views, the surf park offers glamping-style tents equipped with beds, kitchenettes, woodburners, private toilets and balconies. I encourage out-of-town guests to stay on-site, as accessibility can be challenging for those without an automobile.

See also: Riding The Wave: how the UK’s newest surf destination is on a health and wellbeing mission

Goldys practising aerials on the fun waves at The Wave in Bristol, EnglandPhoto courtesy of The Wave

Goldys practising aerials on the fun waves at The Wave in Bristol, EnglandPhoto courtesy of The Wave

Aside from surf and sleep, the property features a great surf shop for last-minute equipment needs or branded surf park gear to commemorate your visit.

When guests book sessions at The Wave, wetsuits, gloves, boots and hoods are included in the price of your session. This is noteworthy as most other surf parks charge to rent wetsuit gear.

Foam surfboards are included for beginner to intermediate sessions, and a range of high-performance hard surfboards are available to rent for a charge.

Surf park stats: The Wave’s surf pool measures around 180 meters long by 200 meters wide at the shoreline. That is around the size of four football pitches.

Real customer perspective: The Wave was a backup surf park I visited when my original plan fell through after another wave pool broke down and cancelled all my sessions. With low expectations, I was pleasantly surprised by how fun the waves were at The Wave, how friendly the staff were, and how tasty the F&B was right onsite!

The only challenge was getting to the venue without a car, since public transportation and ride-sharing didn’t reach this pool from the nearest short-term rental.

3) OANA Surf, Switzerland

When you say shopping mall, one doesn’t think of surfing. But OANA Surf defies location and offers a fun and vibrant environment for guests visiting the Mall of Switzerland.

This deep-water standing-wave pool opened in 2018 as Switzerland’s first and only indoor surf spot, allowing year-round riding in warm water regardless of frigid Swiss temperatures.

The surf park features a 7.5-meter-wide Citywave stationary wave, offering 45-minute sessions with guidance levels: basic, advanced, and intense. Softtop surfboards are available for riders, or high-performance hard surfboards can be rented at a cost.

Goldys enjoying warm water surfing at OANA Surf in SwitzerlandPhotographer: Alexis Feuille

Goldys enjoying warm water surfing at OANA Surf in SwitzerlandPhotographer: Alexis Feuille

Special event surf sessions include board testing, late-night surfing, yoga & surf, kids surf school, and surfing competitions.

While there are plenty of eats within walking distance to OANA Surf – it is inside a large mall after all – there is no need to leave the surf park premises.

The in-house OANA Café & Bar prepares fresh, healthy snacks, including soups, sandwiches, bowls, and pizzas. Feeling parched between surf sessions? Guests can order teas, coffees, cocktails, wine, beer, soft drinks and smoothies.

Surf park stat: This deep-water stationary wave pool maintains a toasty 25–26°C (77–79ºF) water temperature all year long.

Real customer perspective: OANA Surf was the first deep-water standing wave pool I ever experienced. I arrived with low expectations, but left stoked to continue surfing this wave-pool style thanks to the awesome experience OANA created.

Everything you need to spend a day at the wave pool is right there: never-ending waves, surf shop, bar, restaurant, viewing areas, rental boards, showers, locker room and a tropical vibe juxtaposition from the shopping mall it’s attached to. The only thing missing is on-site accommodation.

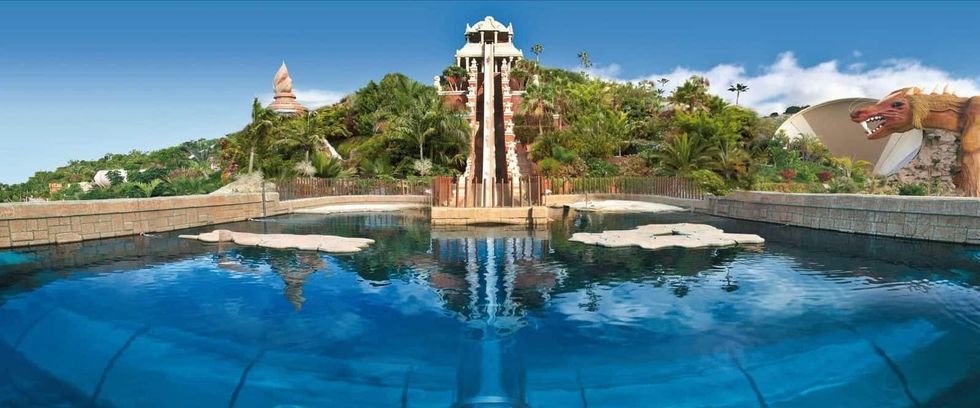

4) Waco Surf, Texas

Waco Surf has an established legacy built on consistently fun waves, family-friendly waterpark activities, and groundbreaking creative events (e.g., Swatch Nines).

The PerfectSwell wave technology, developed by American Wave Machines, was installed at the former 450-acre Barefoot Ski Ranch (aka BSR) back in 2018.

The wave pool offers wave heights and power for all skill levels, from learning to surf all the way to a powerful “Slab Barrel Wave.” Most of my first-hand sessions have been in the 60-minute advanced sessions that provide chest-to-head high waves, allowing me to progress.

Waco Surf - The wave pool so nice, Goldys visited twicePhotographer: Rob Henson

Waco Surf - The wave pool so nice, Goldys visited twicePhotographer: Rob Henson

One benefit to the PerfectSwell wave pool design is that the pool offers both right-breaking and left–breaking waves in the same session. Regular (left-foot-forward) and Goofy (right-foot-forward) surfers can experience both frontside and backside riding in public sessions.

The pool produces about 3,000 waves a day when open for the full 10-hour peak season day.

Every surfer wants to show off their Waco waves, so the wave pool has built-in Flowstate AI cameras that capture every surfer’s rides. Or connect with in-house surf photographer Rob Henson for amazing high-resolution captures of yourself.

The surf park offers a healthy quiver of rental surfboards, covering all shapes and sizes. Wetsuits are also available for hire.

Pumping waves aside, the attraction offers more than just surfing, with lazy rivers, water slides, splash pools, recovery pools and an array of eats. Food options include the Surfside Shack and Wedge Grill, plus several drink stops such as Dive Bar, Lakeside Saloon, and Star Bar.

This surf park has been evolving constantly and has some grandiose plans for the future, including additional wave pools and a surf-anchored community. Keep an eye on Waco Surf.

Surf park stats: Flowstate AI camera software reported 38,000+ total surfers riding 525,000+ waves in the Waco Surf pool in 2025.

Real customer perspective: Waco Surf’s history demonstrates how a change in management can lead to improvement and evolution of an eight-year-old surf park.

As a customer who visited in 2020 and again in 2025, the rebranding, additional onsite food options, fun non-surf activities, and renovated poolside accommodation (down to the complete change in wave pool water color) were evident. Waco Surf was worth a surf several years ago and will remain a solid surf park for guests.

5) o2 SURFTOWN MUC, Germany

The o2 SURFTOWN MUC wave pool opened to the public in 2024, featuring the first of its kind Endless Surf wave-making technology.

The pool's unique shape, combined with pneumatic wave-generating caissons, produces a variety of wave types, including A-frames, barrels, and split peaks that break from one end of the wave pool to the other for up to a 20-second ride.

Similar to other surf parks in this list, sessions range from first-timers to expert level, with many skill levels in between.

The wave pool location is approximately five minutes from the Munich Airport, making it fun to watch planes fly over, and even more iconic if you spot the clear blue surf pool from the airplane POV. If you do, you will see the giant “o2 can do” sponsor at the bottom of the wave pool.

Goldys trying the first surf park in Germany featuring Endless Surf technologyPhotographer: Tanner Wilson

Goldys trying the first surf park in Germany featuring Endless Surf technologyPhotographer: Tanner Wilson

On-site, you will find a spectacular rooftop terrace for spectating, a well-stocked surf shop, the Lookout restaurant/bar and poolside seating areas.

This park was also built with event hosting in mind, offering unique conference rooms with panoramic views of the wave pool. If needed, surfers can rent surfboards, wetsuits, gloves, boots and helmets.

Surf park stats: Germany’s first large-scale surf park offered more than 4,000 surf sessions in 2025. o2 SURFTOWN MUC has become so loved by the local and international surf community that August 2025 was a record month with 18,000 surfers riding the Endless Surf waves.

Real customer perspective: This is the first traveling wave surf park in Germany to feature the first Endless Surf wave technology system, and it was impressive. I got to experience a fun range of wave types in a single pool, and even got to surf the glowing blue water at night.

The restaurant on-site was tasty, but there are few other food options in the vicinity, which can be limiting for out-of-town visitors without transportation. There is no on-site accommodation, so visitors will need to find a hotel near the airport or a 10-minute walk from the surf park.

6) The LineUp at Wai Kai, Hawaii

Situated in Ewa Beach on the west side of Oahu, The LineUp at Wai Kai is home to the world’s largest deep-water standing wave as of 2025.

The 100-foot-wide Citywave can shift between multiple channel configurations, creating a variety of riding experiences for every skill level. It can operate as three separate 30-foot channels, a combined 65-foot channel alongside a 30-foot channel or open up into the full 100-foot-wide wave face.

This flexibility allows beginners and advanced surfers to ride simultaneously in separate zones while maximizing capacity during peak seasons or large group buyouts. Soft surfboards are included with your booked session, and hard performance boards are available to rent.

Goldys enjoying the 100-foot-wide Citywave at The LineUp at Wai KaiPhotographer: Pat Myers

Goldys enjoying the 100-foot-wide Citywave at The LineUp at Wai KaiPhotographer: Pat Myers

The wave pool neighbors a 52-acre lagoon that’s part of the Wai Kai venue. Guests can partake in standup paddleboarding, peddle boating, hydrobiking, outrigger canoeing, kayaking, or explore the AquaAdventure inflatable playground.

The surf park offers a variety of food and beverage options on-site, including sit-down restaurants, a casual cafe, a shaved ice shop, and a coffee bar.

If you walk around, you will also notice Nalo Kai Lounge, some poolside cabanas and the Sessions Lifestyle & Apparel shop.

Wai Kai hosts a mix of weekly, monthly and annual events. Wave pool-centric events include the Thursday night Surf Show, a surf competition series and inclusivity-focused surf sessions like "Wahine Takeover" women ’s-only surf session.

Non-surf events drawing in crowds are the Thursday Farmers Market, live music at The Lookout restaurant and the annual New Year’s party with live music, fireworks and late-night surfing.

For out-of-town guests, there is no on-site accommodation. Hotels are available within a 10-minute drive.

Surf park stats: The LineUp at Wai Kai kept over 16,000 surfers riding in 2025, offering approximately 16 daily sessions to the public; eight on the 65-foot channel and another eight on the 30-foot channel. Public sessions allow up to 10 riders per channel.

Real customer perspective: When I’m in Oahu and don’t want to add to the already crowded ocean breaks, the swell’s flat, or I don’t have time to drive to another part of the island, The LineUp is my go-to. I never have an issue finding parking in their free lot, the food onsite is decent, and there are many surf sessions to choose from throughout the day.

The 65-foot channel is my go-to session for practising tricks. My favorite sessions are at night when the air cools, and the deep-water wave glows from the neon lights below.

7) Atlantic Park Surf, Virginia

Atlantic Park Surf opened in August 2025, featuring the first Wavegarden Cove wave pool in the United States. The 46-module wave-making machine can produce 1,000 waves per hour, providing waves on both the left and right sides of the cove.

The surf park offers a wide range of sessions for all skill levels, including beginner, novice, progressive, intermediate, advanced, expert, and pro.

Speciality sessions for bodyboarders, fireside surfs, Veteran’s Day, surfing with professionals, surfing with Santa and Boardrider club competitions are sprinkled throughout the Atlantic Park Surf events calendar.

Being one of the newest surf parks to open in 2025, the facility is state-of-the-art, offering surfers restrooms, heated indoor + outdoor showers and surfboard racks.

For an additional fee, surfers can rent beach towels, wetsuits, bodyboards, premium soft-top surfboards, performance shortboards, fish shapes, midlengths and longboards.

Goldys enjoying a sunset session in the United States’ newest surf park, Atlantic ParkPhotographer: Andrew Tonra

Goldys enjoying a sunset session in the United States’ newest surf park, Atlantic ParkPhotographer: Andrew Tonra

The wave pool is situated within the larger $350 million Atlantic Park complex, which features a 70,000-square-foot entertainment venue, retail shops, a boutique hotel and 309 luxury apartment homes. Food and beverage options nearby include Mi Vida, The Grill and Wiseguy Pizza.

Unique to this surf park, Atlantic Park is a mix of public and private partnership. Partners range from the City of Virginia Beach, P3 Foundation, Venture Realty Group, and celebrity musician Pharrell Williams (to name a few).

Surf park stats: Atlantic Park Surf’s 2.67-acre lagoon can generate more than 20 types of waves, with some as high as seven feet for experienced riders and others as small as one foot for beginner surfers.

Real customer perspective: The waves are top-notch notch and I exited the wave pool surfed out after every booked session. The barrel waves, in particular, were challenging, but still my personal favorite.

A few things to be aware of: Session costs are high compared to other Wavegarden surf parks around the world, guests not surfing must purchase a beach pass to enter the surf park, and free parking close to the venue in this busy beach town is almost non-existent, so be prepared to pay to park across the street.

8) Surf Stadium, Japan

Surf Stadium Japan opened to the public in 2021, featuring American Wave Machines’ PerfectSwell wave-making technology.

The surf park hosted the Japan and USA Olympic surfing teams for training leading up to the Tokyo 2021 games. This wave pool was particularly newsworthy as it was built less than 700 feet from the Shizunami Beach on the Pacific Ocean.

If you make a visit to Surf Stadium, you will have the option to book intermediate, advanced and expert sessions. The hour-long sessions offer 30 minutes of right-breaking waves and 30 minutes of left-breaking waves.

Costs increase as the wave setting becomes more advanced, but overall, prices per session at this surf park are lower than at most others I have visited firsthand.

The highly sought-after barrel wave is now offered at a premium cost of ¥10,000 for two waves. Barrel waves were limited to booking full-hour, private sessions during my visit in 2024, so you can see that this surf park has since adjusted to customer requests.

Surf Stadium is located 200 meters from the Shizunami Beach on the Pacific OceanPhotographer: Pedro Gomes

Surf Stadium is located 200 meters from the Shizunami Beach on the Pacific OceanPhotographer: Pedro Gomes

Surfboards and wetsuits are available to rent if surfers don’t bring their own.

The surf park is laid out very efficiently, with guest parking across the street, a reception desk for check-in, a surf shop run by local retailer JACK Ocean Sports, changing rooms/restrooms/showers, a restaurant/cafe, and a rooftop terrace on the second level for optimal surf viewing.

CoCo Cafe offers a wide selection of food and drink, covering breakfast, lunch, and dinner. There is an admission fee for non-surfers to enter the surf park, but the ¥550 cost is about $3.50 USD. Admission is free for one person accompanying booked surfers.

Surf park stats: While Surf Stadium Japan doesn’t have a built-in AI camera system or professional in-house photographers or videographers for hire, they are the only surf park I have come across that offers a poolside camera tripod for rent. The setup fee is ¥1000 and applies whether you use their tripod or bring your own.

Real customer perspective: With the flat ocean down the street, I was thrilled to catch fun green waves on demand at the Surf Stadium. The staff were friendly, instruction was provided in English for international guests, and the food at the on-site restaurant was fresh.

Booking sessions from abroad can be challenging as several steps are required (e.g. creating the required free membership), but there is a separate surf park website for foreigners to assist. There was no accommodation onsite, but hotels, tiny homes and other options were very close to the surf park.

9) RiF010, the Netherlands

RiF010 opened in the heart of Rotterdam city in 2024, featuring Surf Loch wave-making technology. What makes this surf park a world’s first is its use of an existing canal, which was drained and retrofitted with a wave pool for surfing and bodyboarding.

Customers can choose from several wave sizes to suit their level of comfort, from the beginner session featuring 1-meter-high waves to the expert-level sessions with 1.6-meter-high waves.

Surfing in the middle of a lively city is an experience unique to RiF010. Two AI-powered Surf Eye cameras capture surfers’ rides and become available for purchase following every day’s sessions.

There are changing rooms, showers and lockers on-site for surfers. Soft top surfboards and bodyboards are free when booking surf lessons, or guests can rent hard performance surfboards for a fee. Outside of surfing, RiF010 offers stand-up paddleboard rentals for the adventurous to explore the city via the Rotte River.

This one-of-a-kind surf park was retrofitted into a Rotterdam canal in the NetherlandsPhotographer: Adriënne Wildeman

This one-of-a-kind surf park was retrofitted into a Rotterdam canal in the NetherlandsPhotographer: Adriënne Wildeman

The Surf Bar & Kitchen offers breakfast, lunch, dinner, and drinks. The best part of the in-house RiF010 restaurant is how close the seating is to the surf action. Some customers might even get wet from riders surfing by!

Upstairs, you will find a surf shop with all the necessities, like surfboards, wetsuits, wax, and cool RiF010 clothing. This surf park is an impressive engineering accomplishment that makes the most of a small space.

Surf park stats: RiF010 pumped out fun waves in the middle of the city for 23,000 surfers who visited in 2025. Only one visitor didn’t care to surf, and that was the local turtle who chilled on the RiF010 deck during the warm summer months.

Real customer perspective: While not the biggest or most powerful waves for surfing, seeing and surfing this wave pool blew my mind. You are right in the middle of a bustling city – surfing! I stayed at a hotel where I woke up, looked out the window and saw waves breaking in a canal.

I do wish this surf park offered left-breaking waves, but the limited space meant it could produce only right-breaking waves.

The wave pool world is only increasing in popularity as an experience-driven attraction. More surf parks are being announced, built, and opening each year. Wave-making technologies are continuously optimizing efficiency, improving wave size + power, and creating new wave types.

It’s an exciting time to be a surfer! Hope to see you in the pool lineup.

Waco Surf

Waco Surf  Goldys trying the barrel waves at Lost Shore Surf Resort in ScotlandPhotographer: Samuel Howard

Goldys trying the barrel waves at Lost Shore Surf Resort in ScotlandPhotographer: Samuel Howard Goldys practising aerials on the fun waves at The Wave in Bristol, EnglandPhoto courtesy of The Wave

Goldys practising aerials on the fun waves at The Wave in Bristol, EnglandPhoto courtesy of The Wave Goldys enjoying warm water surfing at OANA Surf in SwitzerlandPhotographer: Alexis Feuille

Goldys enjoying warm water surfing at OANA Surf in SwitzerlandPhotographer: Alexis Feuille Waco Surf - The wave pool so nice, Goldys visited twicePhotographer: Rob Henson

Waco Surf - The wave pool so nice, Goldys visited twicePhotographer: Rob Henson Goldys trying the first surf park in Germany featuring Endless Surf technologyPhotographer: Tanner Wilson

Goldys trying the first surf park in Germany featuring Endless Surf technologyPhotographer: Tanner Wilson Goldys enjoying the 100-foot-wide Citywave at The LineUp at Wai KaiPhotographer: Pat Myers

Goldys enjoying the 100-foot-wide Citywave at The LineUp at Wai KaiPhotographer: Pat Myers Goldys enjoying a sunset session in the United States’ newest surf park, Atlantic ParkPhotographer: Andrew Tonra

Goldys enjoying a sunset session in the United States’ newest surf park, Atlantic ParkPhotographer: Andrew Tonra Surf Stadium is located 200 meters from the Shizunami Beach on the Pacific OceanPhotographer: Pedro Gomes

Surf Stadium is located 200 meters from the Shizunami Beach on the Pacific OceanPhotographer: Pedro Gomes This one-of-a-kind surf park was retrofitted into a Rotterdam canal in the NetherlandsPhotographer: Adriënne Wildeman

This one-of-a-kind surf park was retrofitted into a Rotterdam canal in the NetherlandsPhotographer: Adriënne Wildeman